Bloodshed

“It is forbidden to kill; therefore all murderers are punished unless they kill in large numbers and to the sound of trumpets.” ― Voltaire

Goodreads

“What difference does it make to the dead, the orphans and the homeless, whether the mad destruction is wrought under the name of totalitarianism or in the holy name of liberty or democracy?” ― Mahatma Gandhi

“Everyone believes in the atrocities of the enemy and disbelieves in those of his own side, without ever bothering to examine the evidence.” ― George Orwell

History never ends.

“History is just one fucking thing after another.”― Alan Bennett

There’s senseless bloodshed again. In trying to make sense of things, I visited The Marginalian by Maria Popova. The site is a priceless repository of the collective wisdom of some of the brightest and most gifted thinkers to have walked the face of the earth. I was searching for this post about hope and despair by Rebecca Solnit that I had read a while ago. As I was searching for the post, I came across the Nobel acceptance speech of Elie Wiesel, an American writer, professor, political activist, Nobel laureate, and Holocaust survivor. The speech is from 1986, but it might as well be about today. Here’s a poignant excerpt:

I remember: it happened yesterday or eternities ago. A young Jewish boy discovered the kingdom of night. I remember his bewilderment, I remember his anguish. It all happened so fast. The ghetto. The deportation. The sealed cattle car. The fiery altar upon which the history of our people and the future of mankind were meant to be sacrificed.

I remember: he asked his father: “Can this be true?” This is the twentieth century, not the Middle Ages. Who would allow such crimes to be committed? How could the world remain silent?And now the boy is turning to me: “Tell me,” he asks. “What have you done with my future? What have you done with your life?”

And I tell him that I have tried. That I have tried to keep memory alive, that I have tried to fight those who would forget. Because if we forget, we are guilty, we are accomplices. We could not prevent their deaths the first time, but if we forget them they will be killed a second time. And this time, it will be our responsibility.

And then I explained to him how naive we were, that the world did know and remain silent. And that is why I swore never to be silent whenever and wherever human beings endure suffering and humiliation. We must always take sides. Neutrality helps the oppressor, never the victim. Silence encourages the tormentor, never the tormented. Sometimes we must interfere. When human lives are endangered, when human dignity is in jeopardy, national borders and sensitivities become irrelevant.

Wherever men or women are persecuted because of their race, religion, or political views, that place must – at that moment – become the center of the universe.

Of course, since I am a Jew profoundly rooted in my peoples’ memory and tradition, my first response is to Jewish fears, Jewish needs, Jewish crises. For I belong to a traumatized generation, one that experienced the abandonment and solitude of our people. It would be unnatural for me not to make Jewish priorities my own: Israel, Soviet Jewry, Jews in Arab lands … But there are others as important to me. Apartheid is, in my view, as abhorrent as anti-Semitism. To me, Andrei Sakharov‘s isolation is as much of a disgrace as Josef Biegun’s imprisonment. As is the denial of Solidarity and its leader Lech Walesa‘s right to dissent. And Nelson Mandela‘s interminable imprisonment.

There is so much injustice and suffering crying out for our attention: victims of hunger, of racism, and political persecution, writers and poets, prisoners in so many lands governed by the Left and by the Right. Human rights are being violated on every continent. More people are oppressed than free. And then, too, there are the Palestinians to whose plight I am sensitive but whose methods I deplore. Violence and terrorism are not the answer. Something must be done about their suffering, and soon. I trust Israel, for I have faith in the Jewish people. Let Israel be given a chance, let hatred and danger be removed from her horizons, and there will be peace in and around the Holy Land.

I’ve been reading and listening to make sense of the Israel-Palestine conflict. Here are some things worth reading and listening to get a sense of this devastating moment.

Historian Niall Ferguson warns of a Third World War

Is Hamas winning the war? By Yuval Noah Harari

Vengeful Pathologies Adam Shatz on the war in Gaza

The Reckoning That Is Coming for Qatar

Podcasts

This conversation between Derek Thompson and Dan Raviv, who’s written several books about Israel, was really good. It’s a good place to start if you want to get the historical context that led to the recent barbarity.

The historical roots of the conflict

Interregnum – The Israel-Hamas conflict

I haven’t yet heard this podcast from the LRB yet but LRB podcasts are awesome. One of the guests on this episode is Adan Shatz whose piece on the topic I’ve linked above.

Video

Wow, I came across this video of Arnold Schwarzenegger thanks to Josh Wolfe. What a powerful and evocative message about not giving into hate.

Pair these conversations with this timeline of the Israel-Palestine conflict.

Humor in dark times

I think the best comedians are philosophers. In my book, George Carlin is a modern-day Aristotle. Comedians are like a mirror; they show the contradictions, idiosyncrasies, and absurdities of life and the human condition like no other. Comedians are also humans, like all of us. They deal with the horrors of life on stage. In doing so, they help us deal with the terrible things in life and give us permission to laugh. Pete Davidson showed this last week as he delivered a moving monologue on SNL on the Israel tragedy:

After my dad died, my mom tried pretty much everything she could do to cheer me up. I remember one day when I was eight, she got me what she thought was a Disney movie but it was actually the Eddie Murphy stand up special, “Delirious.” We played it in the car on the way home and when she heard the things that Eddie Murphy was saying, she tried to take it away. But then she noticed something, for the first time in a long time I was laughing again.

I don’t understand it. I really don’t. I never will. But sometimes comedy is really the only way forward from tragedy.

My heart is with everyone whose lives have been destroyed this week. But tonight I’m going to do what I’ve always done in the face of tragedy and that’s try to be funny. Remember, I said try

In the same vein, Ricky Gervais on the healing power of comedy:

Here’s a a drug is a drug here it cures good shit. I don’t want that. I like good shit. I want something that cures bad shit. Well, laughter’s the best medicine, thank you very much.

In the money

The good side of low interest rates and bubbles

In the last couple of years, the phrase “it was a ZIRP (zero interest rate policy) thing” has become popular. It’s a catchall phrase to dunk on something as the result of low interest rates and not the result of sound fundamentals. The low interest rate phenomenon over the last decade has become a universal pejorative—it wasn’t brains, it was low interest rates. But are low interest rates all that bad?

Not really.

The reality is 38 shades of gray. Yueran Ma and Kaspar Zimmermann published a fascinating paper looking at the impact of rising interest rates on innovation. They found that interest rate hikes lead to less spending on R&D, a drop in tech patents, and a decline in venture capital investments.

We observe meaningful changes in innovation activities in the years following monetary policy shocks. First, investment in intellectual property products (IPP) in the national accounts (NIPA) declines by about 1 percent. The magnitude is comparable to the decline in traditional investment in physical assets. R&D spending in Compustat data for public firms declines by about 3 percent. Second, VC investment is more volatile, and declines by as much as 25 percent at a horizon of 1 to 3 years after the monetary policy shock. Third, patenting in important technologies measured by Bloom et al. (2023) declines by up to 9 percent 2 to 4 years after the shock. Interestingly, patenting in other technologies declines by less than patenting in important technologies.

Although the data suggest that monetary tightening reduces innovation activities, it is possible that downturns also have cleansing effects by eliminating weak companies (Schumpeter, 1942; Caballero 4 and Hammour, 1994; Foster, Grim, and Haltiwanger, 2016). To the extent that such companies are likely to be technologically underdeveloped and less innovative, the innovation measures above may not capture these potential cleansing effects. Gopinath et al. (2017) suggest that low interest rates worsened misallocation in Southern Europe as capital investment by large firms with high net worth increased by more, due to size-dependent borrowing constraints.

This reminds me of another brilliant post by the amazing Byrne Hobart on bubbles. The right kind of bubbles can lead to a lot of positive spillovers.

But even though the term “bubble” is usually pejorative, the right kind of bubble, at the right time, can exert a powerful positive effect on the world. A bubble is an objectively irrational shared belief in a better potential future … but that doesn’t just describe someone bidding up asset prices; it also describes anyone who chooses to build that kind of future. (And it’s not a coincidence that the other social sense of “bubble” is a filter bubble — a fact- and criticism-proof barrier that keeps a set of people convinced against all external evidence that they’re right.)

Bubbles can be directly beneficial, or at least lead to positive spillover effects: The telecom bubble in the ’90s created cheap fiber, and when the world was ready for YouTube, that fiber made it more viable. Even the housing bubble had some upside: It created more housing inventory, and since the new houses were quite standardized, that made it great training data for “iBuying” algorithms — the rare case where the bubble is low-tech but the consequences are higher-tech. But, even so, there’s always the question of price: how can you tell when it’s worth the hype?

Takeaway: Most things in life are 87 shades of gray. While having absolute views and passing judgment is easy, reality is always nuanced.

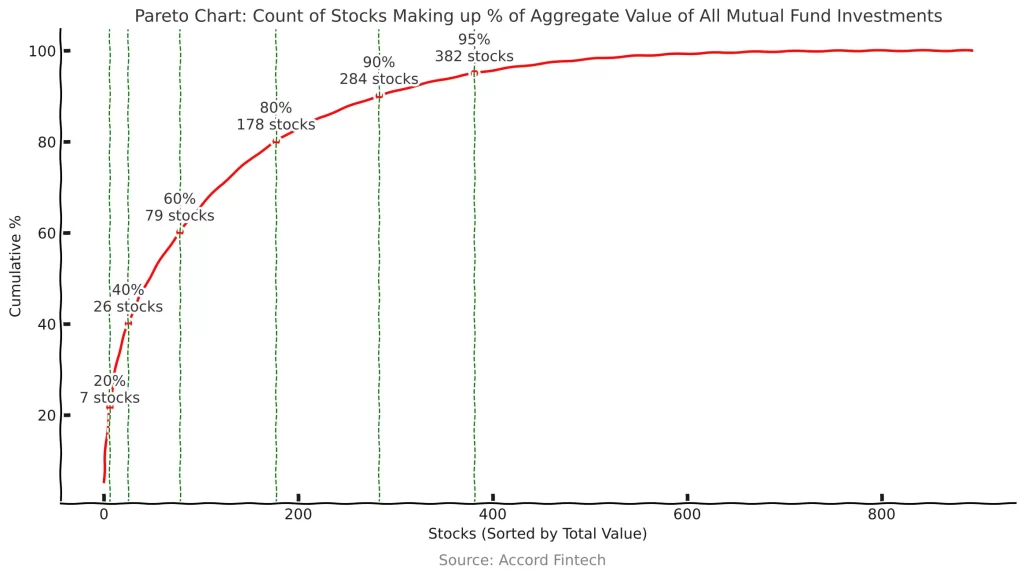

The incredible shallowness of the Indian markets

India growth story

Robert Armstrong, Ethan Wu and Adam Tooze on the India growth story

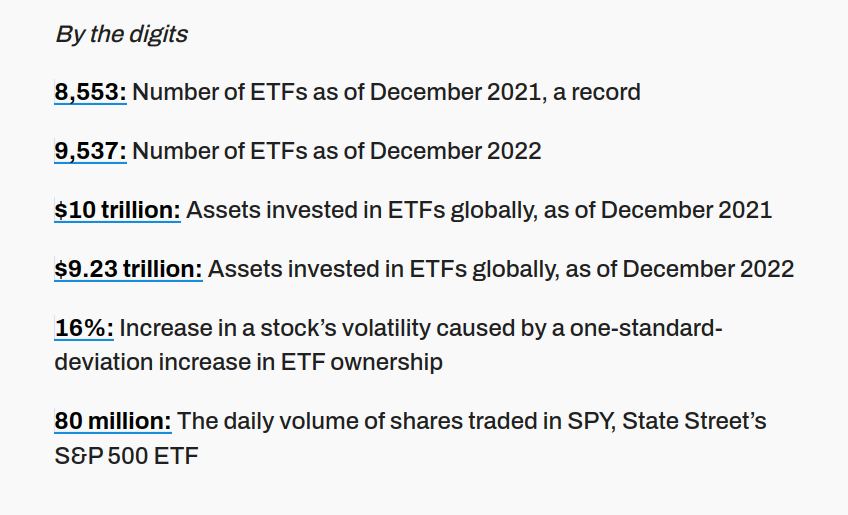

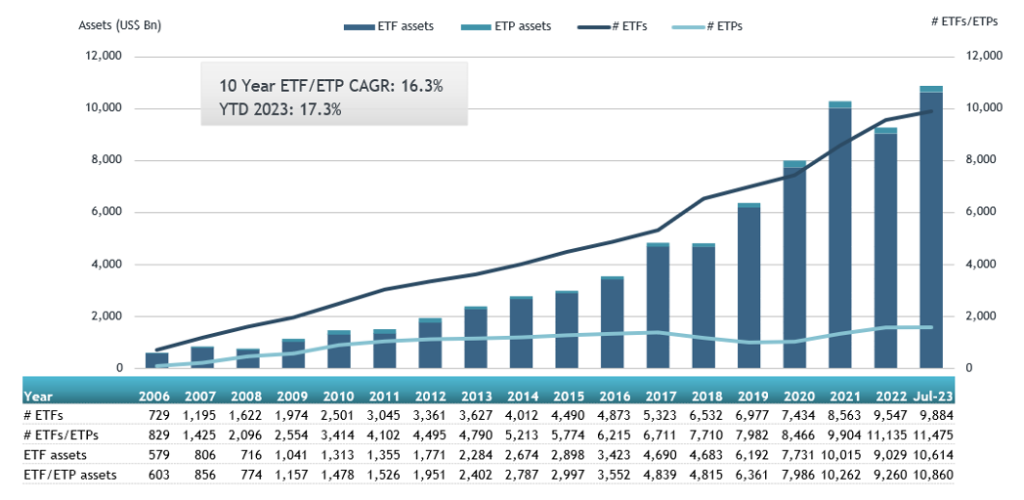

Age of exchange traded funds (ETFs)

Exchange traded funds are nothing short of a revolution. They’ve changed the way not just retail investors invest but also institutions.

These numbers are all the more amazing considering the fact that much of the growth in ETF AUM has occurred post-2008.

ETFs have grown so large that there are active debates about their impact on market microstructure. A few papers and articles come to mind. In his brilliant paper liquidity cascades, Corey Hoffstein had a fascinating section on the destabilizing effects of basket trading:

Flow traded to track a basket is incentivized not to identify the right value for a given security, but to minimize the impact of that flow in the market and execute the trade as efficiently as possible.

This distinction is important because in the latter case, the authorized participant knows the price of everything but the value of nothing. And as a larger percentage of market flow is directed towards basket trades, it may create a destabilizing influence upon markets. For example, studies show that baskets can lead to “information linkages” between securities in the same basket. This can lead to persistent distortions from fundamental value for individual securities, as “market makers cannot perfectly distinguish between price changes caused by factors pertinent to their assets, and other factors irrelevant to them.”

Further, market makers may not be able to instantaneously synchronize their prices, which may lead to further price distortion. In fact, stocks with higher ETF ownership display significantly higher volatility, higher trading costs, higher “return synchronicity,” a decline in “future earnings response,” a decline in analyst coverage, and evidence even suggests that ETFs may even introduce a new source of noise to markets.

In a paper last year, Koont et al. argued that bond ETFs boost liquidity in normal times, but in turbulent market phases like the COVID crash, they reduce the liquidity of the underlying bonds.

ETFs’ efforts to improve the liquidity of their shares have consequences for the liquidity of the underlying securities. We find that a bond’s inclusion in an ETF basket has a significant state-dependent effect on the bond’s liquidity. This effect is positive in normal times but negative in periods of large imbalance between creations and redemptions. A salient example occurred in the spring of 2020. The COVID-19 crisis witnessed acute selling pressure in the bond market, which led to net redemptions from bond ETFs, which in turn strained the liquidity of the bonds concentrated in RD baskets. Given the growing role of ETFs in liquidity transformation, future episodes of ETF-induced liquidity strains seem likely

But not everyone agrees:

“The illiquidity is causing the issuer to put it in a more concentrated weight in the basket to try and either get us to take it from them or find a price,” said Izzo, who argued that the rise of ETFs had actually increased liquidity during periods of market stress.

An excerpt from a whitepaper about ETF performance during COVID by BlackRock:

Rather than exposing a flaw in the ETF structure, these discounts highlighted how fixed income ETF prices can provide a window into underlying market conditions, transmitting real-time information and providing price discovery for market participants. Bonds that trade infrequently may not have current market sentiment fully embedded in their prices, which means end-of-day NAVs may not represent up-to-date market levels. ETF market prices adjust quickly in rapidly changing markets, so the trading price of the ETF can be a source of price discovery of where investors are valuing the underlying portfolio of bonds.

The discontents of being rich

The inimitable Morgan Housel published a brilliant post on the downsides of being rich. I have chosen to worry about these after being rich.

Magic pills

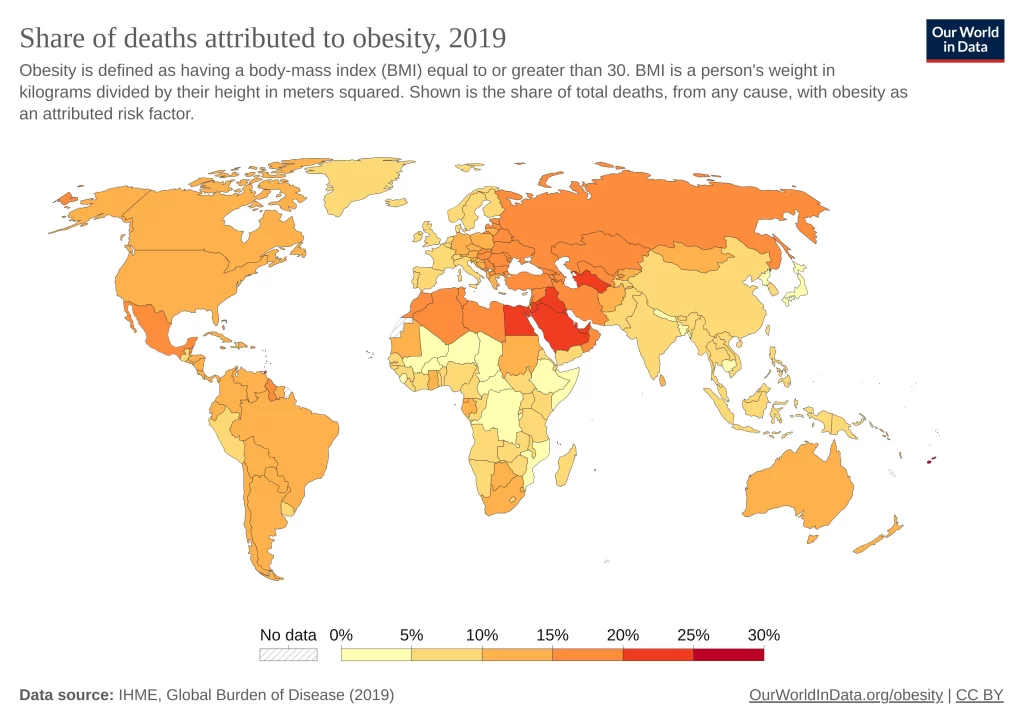

Obesity is a real killer. It kills more people than car crashes and terrorism combined and the rates continue to climb around the world. The lack of physical activity isn’t the only cause.

What if there was a miracle pill that could cure obesity?

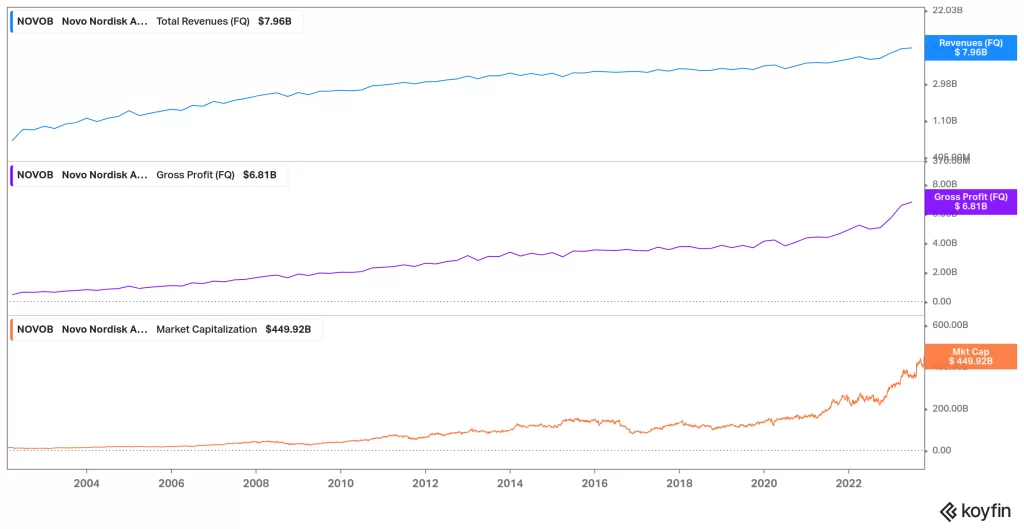

We have one, and it’s called semaglutide. The injectable drug is sold under brand names like Ozempic and Wegovy. Semaglutide was developed to treat type 2 diabetes. The drug works by making you feel fuller for longer, so you end up eating less. Soon, people discovered that it only helped manage diabetes, but one of the side effects was drastic weight loss.

The drug exploded in popularity almost overnight, leading to massive shortages. The demand sparked a gold rush, leading to the development of an alternate marketplace where people sell off-brand formulations of the drug. Pharma companies have also jumped on the bandwagon, developing several alternate formulations that seem to deliver better results than Ozempic and Wegovy.

Novo Nordisk, the Danish pharma company that manufactures Ozempic and Wegovy, is raking it in.

It seems like the drug’s miraculous effects aren’t limited to diabetes and weight loss. If you go by anecdotes, it seems to be helping with addiction and other compulsive behaviors.

As semaglutide has skyrocketed in popularity, patients have been sharing curious effects that go beyond just appetite suppression. They have reported losing interest in a whole range of addictive and compulsive behaviors: drinking, smoking, shopping, biting nails, picking at skin. Not everyone on the drug experiences these positive effects, to be clear, but enough that addiction researchers are paying attention. And the spate of anecdotes might really be onto something. For years now, scientists have been testing whether drugs similar to semaglutide can curb the use of alcohol, cocaine, nicotine, and opioids in lab animals—to promising results.

Corry Wang on Twitter posed an interesting question:

7/ How many American industries have been propped up for the last 50 years by the poor impulse control of a small cohort of people with eating problems, drinking problems, and gambling problems? Guess we’ll find out in a year

Can these drugs break the economy? What happens if people stop smoking, gambling, and eating? Josh Barro argues that such behavioral shifts will be good for the economy at large:

It is theoretically possible that a major positive social and public health change could lead to reduced economic output — American consumers could take all their savings from eating less and drinking less and making fewer impulsive shopping decisions, and put them toward a reduction in work hours and earlier retirement — but that is not usually how these things work.

Consider an area where we’ve had a lot of success fighting addiction over the last few decades: reduced smoking rates. You could tell a story where reduced spending on cigarettes depresses corporate profits and GDP — that ex-smokers spend less, and this allows them to work less and retire earlier. But that seems obviously wrong — ex-smokers work more than still-smokers because they are less burdened by disease and disability. What are those ex-smokers doing with the proceeds of their greater productivity?

Presumably, they’re taking their earnings and spending more than they otherwise would have on non-cigarette products and services. And even if their financial gains from not smoking are going into savings instead of consumption, that is still fueling economic activity — a positive shock to the savings rate pushes interest rates down and makes it easier for businesses to invest and individuals to consume, even if those individuals never smoked.

Here’s an interesting comment from the CEO of Walmart:

Last week, Walmart’s chief executive John Furner said that customer data, which compares people’s prescription history against their food shopping patterns, suggested those taking the obesity drugs were buying less food. “We definitely do see a slight change compared to the total population — we do see a slight pullback in the overall basket,” he said.

The sell side guys always come up with the best takes:

CITI’S TAKE It is possible that increased use of Ozempic, Wegovy and related weight loss/diabetes treatments could materially contribute to weight loss efforts of its users in the United States. However, digging through some of our recent work on A320 flight capabilities, the potential payload benefit from transporting lighter passengers is negligible, especially on shorter-distance flights. Use of these treatments would seem to have to be far more widespread to have any meaningful impact on A320 mission capabilities. Citi maintains Buy ratings on Delta, Copa, United, Air France/KLM, Volaris and Azul, among others.

I give it three weeks until Morgan Stanley counts the number of farts and shows how semaglutide can solve climate change by reducing farts.

While these drugs do help reduce weight, they have plenty of side effects. The amazing Izabell Kaminska, formerly of FT Alphaville, shares her experience with semaglutide:

About a year later, someone told me that the drug was now available in weekly form. Convinced I had messed things up because of erratic dosing, I decided to give it another go. This time the immediate effects were negligible. I didn’t get my ego-boosting first-week mega loss. And overall, if the drug did anything, it suspended my continuing and ongoing weight gain rather than helped me to lose more. Nor did the weekly injections prevent the nausea or brain fog.

The negatives weren’t quite as bad, but the upsides were far more limited. Utterly underwhelmed and disillusioned, especially since the price of the pens remained prohibitively expensive, I gave up again. And again, I ballooned after doing so.

Dive deeper

Ozempic: Metabolizing the market

Should Insurance Cover Wegovy, Ozempic and Other New Weight-Loss Drugs?

Will the Ozempic Era Change How We Think About Being Fat and Being Thin?

Out of the money

Dirty clean energy

Meera Subramanian published a brilliant post about the Pavagada Ultra Mega Solar Park in Tumkur, Karnataka. The post chronicles the side effects of the push to decarbonize on local communities, marginalized groups, biodiversity, and rural economies.

“Solar people are building schools in all the villages, building roads,” Varshitha Gopala, an eighteen-year-old who lives in Vollur, told me. “For people, they haven’t done anything.” Gopala’s family lives in a Dalit-majority area, and her mother, Alvelamma, told me that Dalits were given farmland to work generations back. Before solar came, all women who could work did work, she said, whether on their own lands or as laborers for their landowning neighbors. But this arrangement had never come with a deed, which meant that Dalits were ineligible for a lease agreement and lost access to the land. Their landed neighbors now earn lease income, but the jobs are gone.

Clean-energy projects risk gaining a reputation for being extractive, in the same way that many fossil-fuel projects are. “Transformations are happening at this scale without any democratic process,” Saldanha said.

The Sound So Loud That It Circled the Earth Four Times

Why Do Superheroes Wear Spandex?

That’s it for this week. There were a few more interesting rabbit holes I went down, but in the interest of brevity, let me stop here. Now eat Lays chips, fart and make someone laugh.

1 Pingback