The interweb is like a smelly public toilet with no doors near the Majestic Bus Stand. But the toilet becomes just a little bearable for you to finish unburdening yourself when a strong wind blows through the door, sweeping away the fresh and pungent Chanel N°5 odors of fellow travelers. In that split second, you can discover some wonderful things on the interweb. This blog is an ongoing journal of such things.

Here are some amazing things I discovered this week.

- Hope vs. despair

- Carbon credits a giant scam

- Myths about electric vehicles

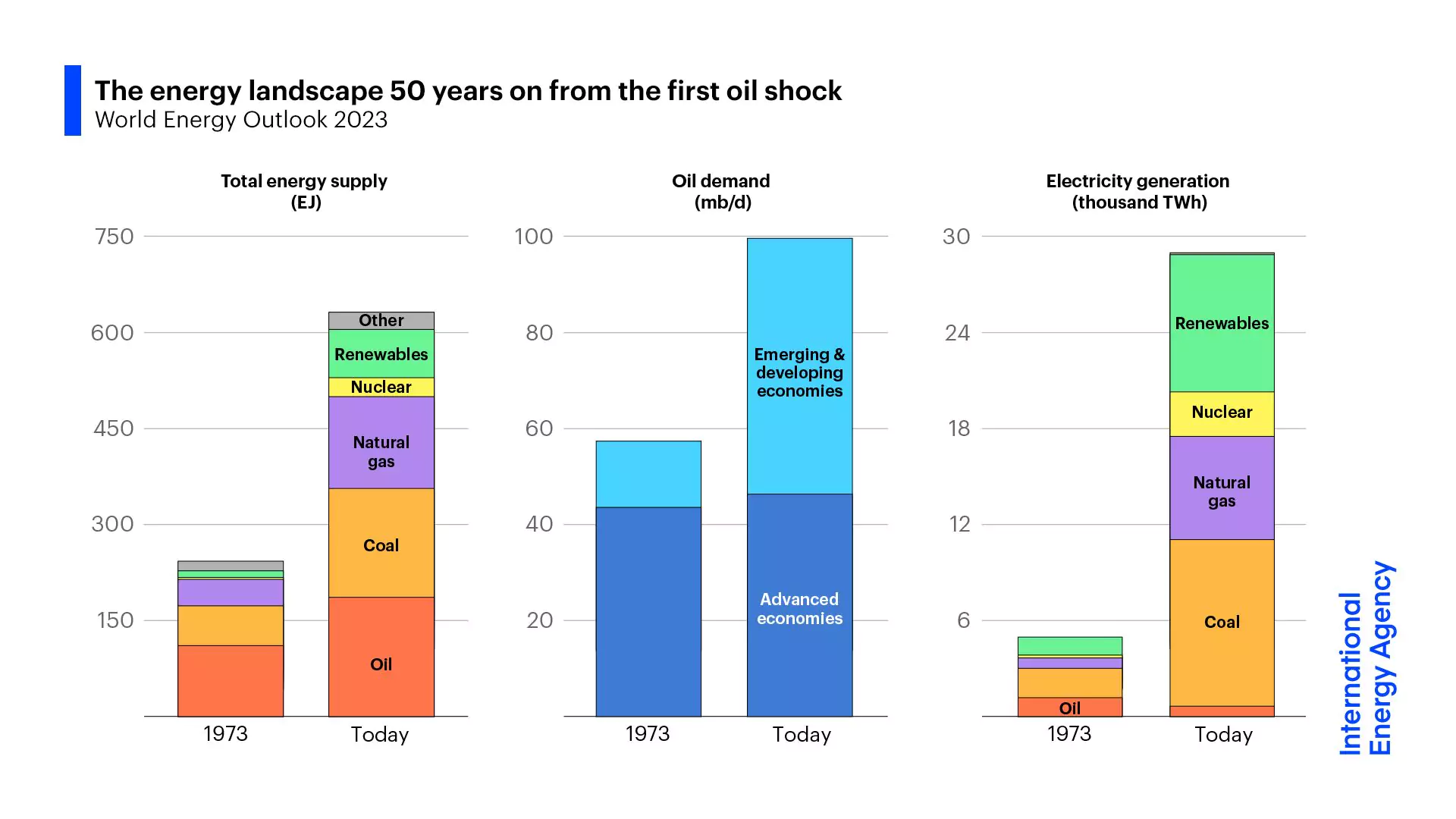

- Summary of the IEA World Energy Outlook 2023

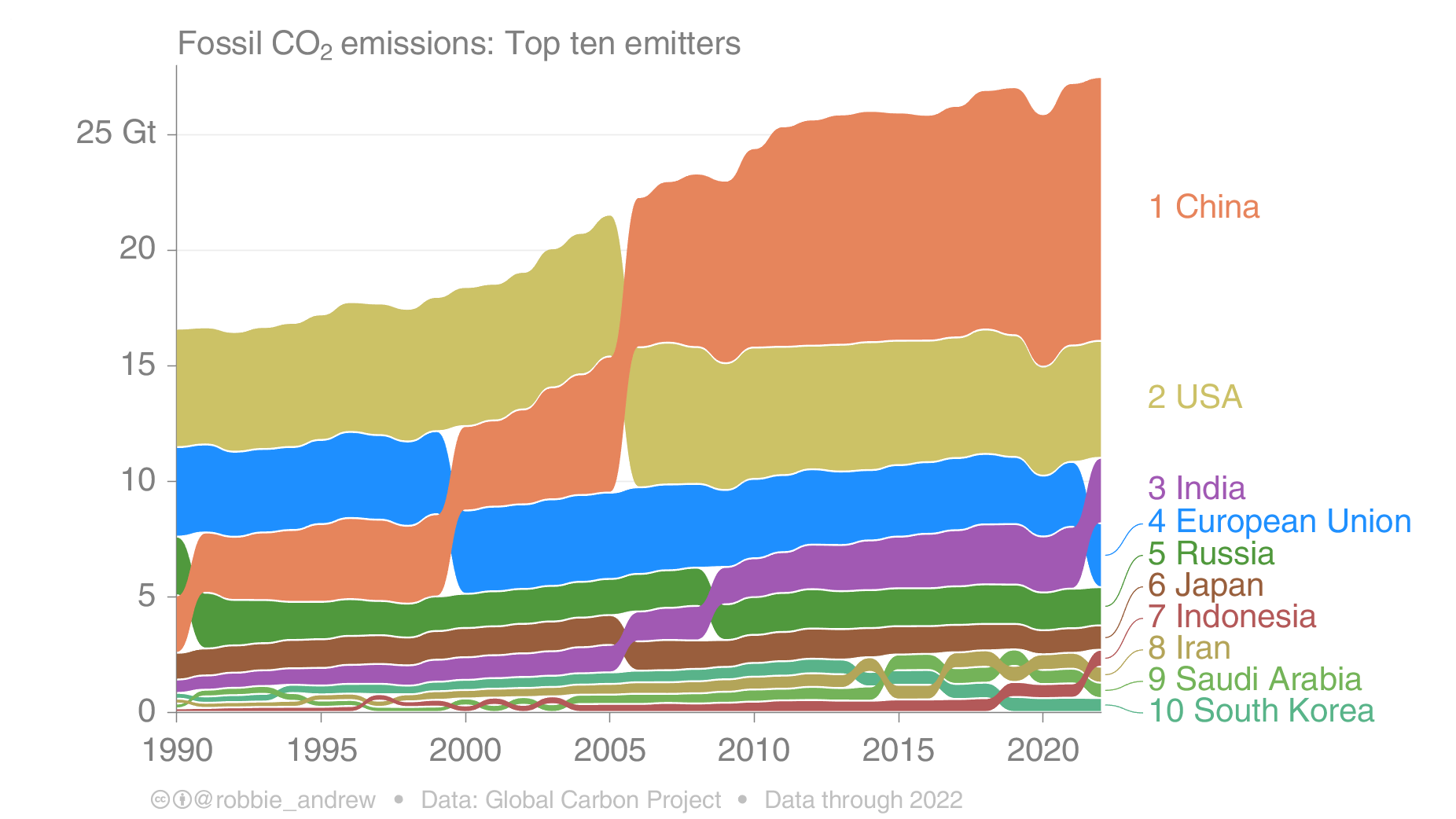

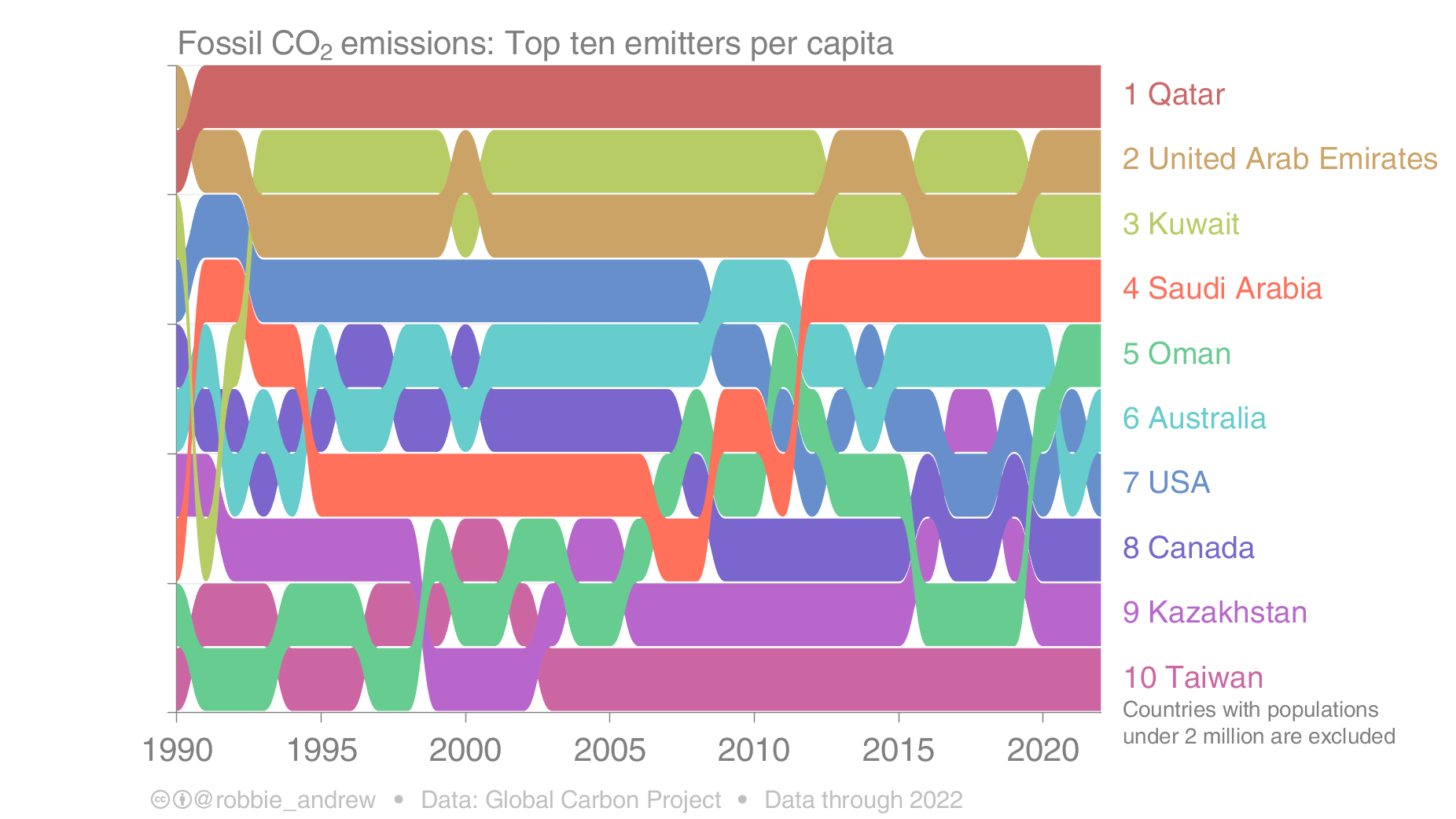

- The world’s largest carbon emitters in 2022

- In defense of rats

- Patrice O’Neal on people tricking God

- Victor Haghani reminisces about his days at Long Term Capital Management (LTCM).

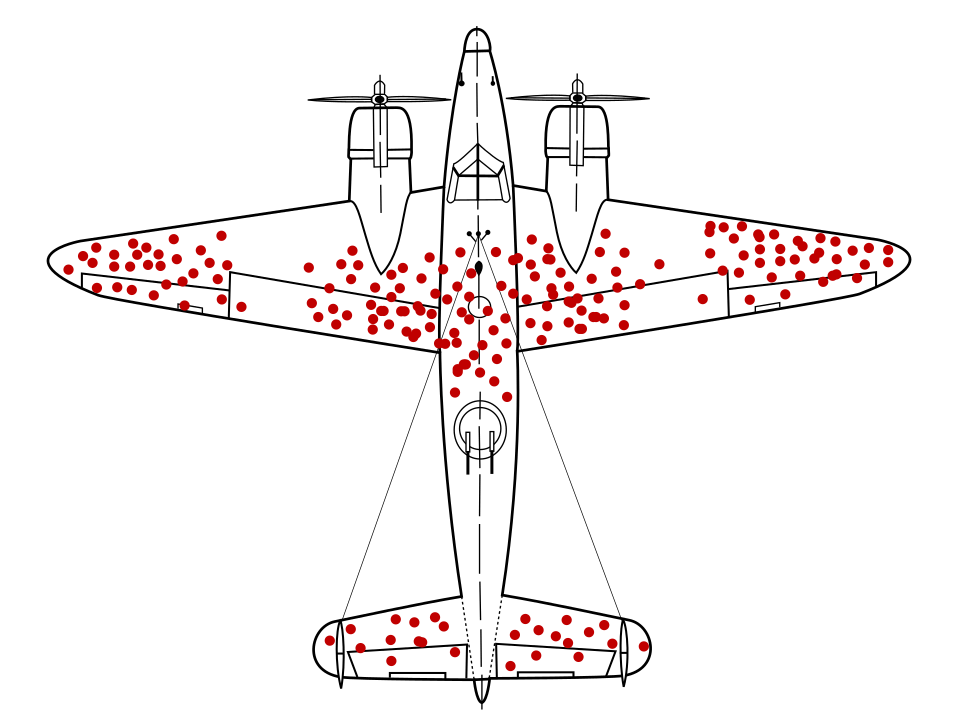

- Survivorship bias

- Professor Aswath Damadoran’s interview

- Big market delusions

- Demographics are not destiny.

Out of the money

Age of discord

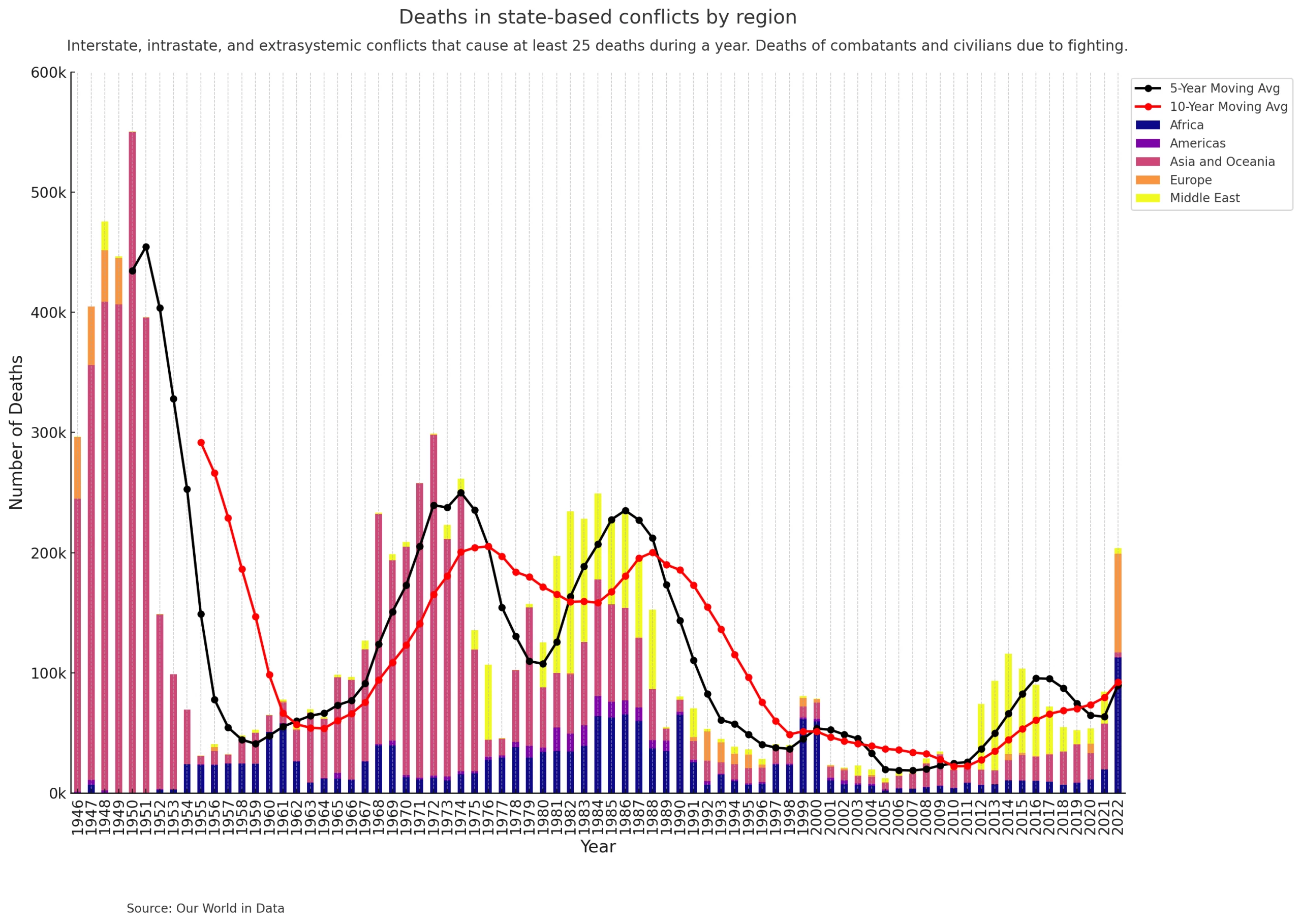

Conflicts are popping up all across the world. While a lot of people are shocked and lamenting that it’s the end of history or the end of end of history, I am not. This isn’t surprising at all to me because I am a technical analyst. Last year, I did technical analysis on the number of conflicts around the world, and there was a bullish moving average crossover. The fact that people are talking about World War III as if it’s the latest Call of Duty game release is not surprising to me. Technical analysis predicts everything.

Ok, that’s a terrible joke. The reason I made this joke is because there’s this pervasive belief that the long peace is over and we’re heading into an age of conflict. I’ve no idea what the future holds, and neither does anybody else. As I was reading about the bloodshed in the Middle East last week, I read a few wonderful articles on hope and despair in The Marginalian, and they stuck with me. The reason is because the topic of positivity vs. negativity is something I’ve long thought about, both personally and in the context of investing. Reading these perspectives was moving, and I couldn’t resist sharing them.

The poetic Rebecca Solnit on what hope is:

“Hope doesn’t mean denying these realities. It means facing them and addressing them by remembering what else the twenty-first century has brought, including the movements, heroes, and shifts in consciousness that address these things now.”

― Rebecca Solnit, Hope in the Dark

“It’s important to say what hope is not: it is not the belief that everything was, is, or will be fine. The evidence is all around of tremendous suffering and tremendous destruction. The hope I’m interested in is about broad perspectives with specific possibilities, ones that invite or demand that we act. It’s also not a sunny everything-is-getting-better narrative, though it may be a counter to the everything-is-getting-worse narrative. You could call it an account of complexities and uncertainties, with openings. “Critical thinking without hope is cynicism, but hope without critical thinking is naïveté,” the Bulgarian writer Maria Popova recently remarked. And Patrisse Cullors, one of the founders of Black Lives Matter, early on described the movement’s mission as to “Provide hope and inspiration for collective action to build collective power to achieve collective transformation, rooted in grief and rage but pointed towards vision and dreams.” It’s a statement that acknowledges that grief and hope can coexist.”

This passage by Zadie Smith landed like a punch to my brain:

Only the willfully blind can ignore that the history of human existence is simultaneously the history of pain: of brutality, murder, mass extinction, every form of venality and cyclical horror. No land is free of it; no people are without their bloodstain; no tribe entirely innocent. But there is still this redeeming matter of incremental progress. It might look small to those with apocalyptic perspectives, but to she who not so long ago could not vote, or drink from the same water fountain as her fellow citizens, or marry the person she chose, or live in a certain neighborhood, such incremental change feels enormous.

― Zadie Smith, Feel Free: Essays

Helen Keller became blind and deaf when she was just 19 months old. Yet she overcame that adversity to become one of the most inspiring figures we’ve ever known. This particular excerpt has been playing on rewind in my brain since I read it last week:

Once I knew only darkness and stillness. Now I know hope and joy. Once I fretted and beat myself against the wall that shut me in. Now I rejoice in the consciousness that I can think, act and attain heaven. … Can anyone who escaped such captivity, who has felt the thrill and glory of freedom, be a pessimist?

My early experience was thus a leap from bad to good. If I tried, I could not check the momentum of my first leap out of the dark; to move breast forward as a habit learned suddenly at that first moment of release and rush into the light. With the first word I used intelligently, I learned to live, to think, to hope.

Optimism that does not count the cost is like a house builded on sand. A man must understand evil and be acquainted with sorrow before he can write himself an optimist and expect others to believe that he has reason for the faith that is in him.

There is no love of life without despair of life.

Albert Camus

Climate as an asset class

The tragedy of our time is that we live under the tyranny of market logic, or price signals. An entire generation of economists and bureaucrats has grown up with the idea that markets solve everything. Whenever there’s a problem, the default impulse is to look toward the markets for solutions—what if we put a price on a problem? Over the past 50-60 years, this neoliberal belief system has been driving ideology across much of the world.

“The government is not the solution to our problem, government is the problem.”

Ronald Reagan

The notion that governments suck and that markets are better at allocating resources has become gospel. There’s no place for nuance. This ideology didn’t just appear out of thin air; it was an explicit political project by a committed group of economists, businessmen, legal scholars, and politicians. It originated in Europe and the US but spread like a virus to the rest of the world.

“I react pragmatically. Where the market works, I’m for that. Where the government is necessary, I’m for that. I’m deeply suspicious of somebody who says, “I’m in favor of privatization,” or, “I’m deeply in favor of public ownership.” I’m in favor of whatever works in the particular case.”

— John Kenneth Galbraith

While there’s a tremendous backlash against these ideas, they are deeply entrenched and still shape our world. Take the example of climate change. You would think that if humanity knew that it was going to slowly burn to death, it would act to save itself.

Nope.

Humanity decided that they might as well get comfortable, switch on the AC, and enjoy the free tan. But politicians and policymakers couldn’t be seen as doing nothing. It was the end of the world, not a flat-earth protest. They had to show some minimum viable concern—a pretense that they were mildly worried that the world was ending. So they looked toward the markets for an easy solution.

In a surreal moment of brilliance, the people in power decided to put a price on climate change. If we’re going to choke and slow burn to death, we might as well make some money, went the logic. It’s personal finance 101! Lo and behold, the voluntary carbon markets were born. What if you put a price on carbon emissions? What if you paid people not to pollute? They could just buy and sell carbon credits and carbon offsets and continue polluting happily.

Did you know? Sheryl Sturges is credited with inventing the carbon credit. In 1987, Sherly was working at the AES Corporation, which built coal-fired power plants. Global warming was becoming a part of the conversation, and Dennis Bakke, the CEO of AES, was worried and asked Sheryl to figure out ways to minimize the company's impact. Sherly looked through a bunch of ideas and had a light bulb moment: what if you planted some fast-growing trees? She asked scientists to figure out if the idea was feasible, and soon she had a number—AES had to plant 52 million trees over 10 years, but there was no space around the plant. She then figured, What if you plant the trees elsewhere? They identified Guatemala as the spot and paid struggling farmers to plant trees, and the carbon credit was born.

Carbon credits are magical certificates that allow a company to continue polluting as long as it offsets it. Carbon credits and offsets are created from projects that reduce or remove carbon emissions, like reforestation projects, reducing deforestation, renewable energy projects, and now carbon capture. Each credit represents one ton of carbon dioxide (CO2) or equivalent gas. So polluters like fossil fuel companies, manufacturing companies, and even individuals can buy carbon credits to the extent of their pollution and sleep well knowing they are “carbon neutral.”

Brilliant idea. What could go wrong?

In short, even in countries better known as polluters than green leaders, things are shifting. By the beginning of 2023, 23% of global emissions were covered by a carbon price, up from just 5% in 2010. The spread will only accelerate over the coming years as more countries come round to the advantages of carbon pricing, and schemes expand their reach. According to the imf, 49 countries have carbon-pricing schemes, and another 23 are considering them

How carbon prices are taking over the world | The Economist

Heidi Blake published a damning expose of South Pole, a leading developer of carbon projects, in The New Yorker. In 2010–2011, South Pole entered into an agreement with Steve Wentzel, a Zimbabwean businessman who owned parcels of forestland near Lake Kariba in Zimbabwe. The deal would generate carbon credits by conserving the forestland and preventing deforestation. South Pole helped sell over 20 million credits to companies ranging from Volkswagen, Gucci, Nestlé and Porsche, allowing these companies to claim they were “carbon neutral.”

But in reality, South Pole overestimated the deforestation avoided and was generating more credits than the emissions that the project supposedly prevented. Not just that, despite knowing that their estimates were flawed, the company continued selling credits and making money. The company also seems to have made millions of dollars by speculating on the same credits.

Satellite data recently collected by South Pole shows that the company has severely overestimated the deforestation.This is good news for the climate but bad news for South Pole’s business: currently, the company is overestimating the deforestation it would have prevented by about a factor of 14.

Follow the money

The overestimation of carbon offsets is not the only bombshell under the Kariba project. South Pole publicly claims that it keeps 25 per cent of the project’s revenue as commission and that the remainder flows back to CGI, the project itself and the local people. But South Pole confirms to Follow the Money that it actually pocketed considerably more. Through a clever trick, it kept not a quarter but more than 40 per cent of the approximate 100 million revenue for itself.

To register the Kariba project with Verra, South Pole had to predict how much of the forest would be lost without any intervention, and thus determine how much carbon the scheme would conserve over a thirty-year life span. Credits would be issued every year against that total, and the prediction would be checked once a decade, by comparing Kariba with an unguarded reference area nearby. South Pole’s data analysts initially estimated that the program could save around fifty-two million tons of carbon. But Verra required them to rerun these calculations using one of its approved methodologies. The scientists used one named VM9, which generated a startlingly different projection: if the Kariba site was left undefended, deforestation would explode, resulting in the eventual loss of ninety-six per cent of the forest. On that basis, the project would be eligible for almost two hundred million credits—four times the initial estimate.

The Great Cash-for-Carbon Hustle | The New Yorker

This isn’t the first time people have exposed the uselessness of carbon credits. Earlier this year, an investigation by the Guardian, Die Zeit, and SourceMaterial found that over 90% of credits from projects certified by Verra were useless. Verra is a nonprofit that maintains several climate action standards and certifies over 70% of all voluntary carbon credits were useless:

The Guardian

- Only a handful of Verra’s rainforest projects showed evidence of deforestation reductions, according to two studies, with further analysis indicating that 94% of the credits had no benefit to the climate.

- The threat to forests had been overstated by about 400% on average for Verra projects, according to analysis of a 2022 University of Cambridge study.

- Gucci, Salesforce, BHP, Shell, easyJet, Leon and the band Pearl Jam were among dozens of companies and organisations that have bought rainforest offsets approved by Verra for environmental claims.

Research by the University of California (UC) Berkeley Carbon Trading Project came to similar conclusions:

Ultimately, it is illusory to assume that forest conservation activities can be used to compensate for greenhouse gas emissions from the combustion of fossil fuels. They must not be lumped together into a single net value and accounting for their impacts must remain separate. This should not deter companies and governments from financing forest conservation, in particular for primary forests, but this should be done without using these investments to claim the offsetting of emissions.

Error Log: Exposing the methodological failures of REDD+ forestry projects

Also read:

‘Worthless’ forest carbon offsets risk exacerbating climate change

Carbon credits also face other challenges, one of the biggest being “leakage” or displacement of deforestation. Leakage may occur because the people who were cutting down the forest simply relocate to a different area. Alternatively, demand for food or timber that was fuelling deforestation in one place may be met by deforestation elsewhere – perhaps on the other side of the world. Another problem is ensuring that the forests are protected in perpetuity so that reduced deforestation represents permanent removal of carbon from the atmosphere.

Julia P G Jones, Professor of Conservation Science, Bangor University.

Neal Hockley, Senior Lecturer in Environmental Economics & Policy, Bangor University.

A tonne of fossil carbon isn’t the same as a tonne of new trees: why offsets can’t save us

It’s simply not possible to fully “offset” billions of tonnes of greenhouse gas emissions from burning of coal, oil and gas by regrowing forests, increasing the amount of carbon in soils or other measures. That’s because the carbon dioxide released by burning fossil fuels is fundamentally different to the way carbon is stored above ground in trees, wetlands and in the soil.

To compound the problem, much of the carbon stored in land-based offsets does not stay stored. Forests can easily be destroyed by fire, disease, floods and droughts, all of which are increasing with climate change.

Wesley Morgan, Research Fellow, Griffith Asia Institute, Griffith University.

There are more dimensions to the idea that we are turning climate and nature into asset classes, but more on that next week.

Climate stuff

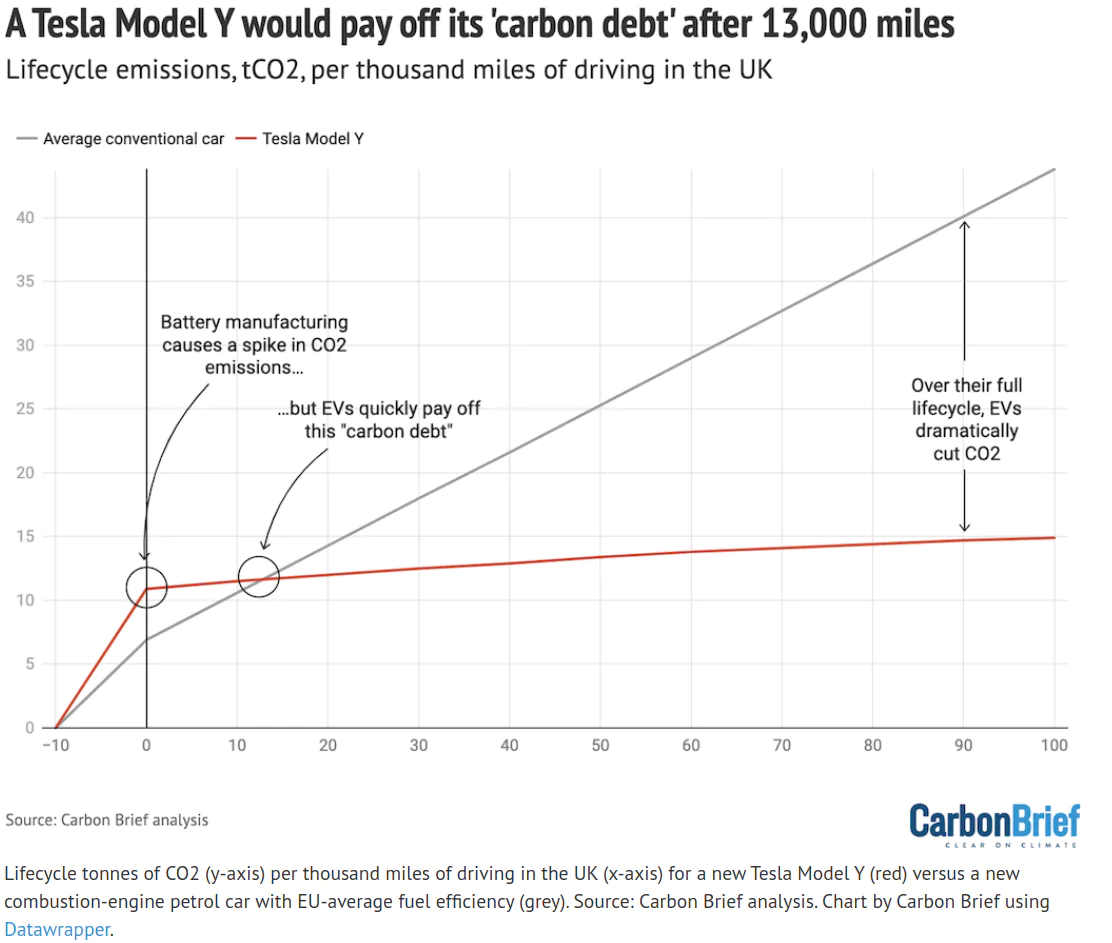

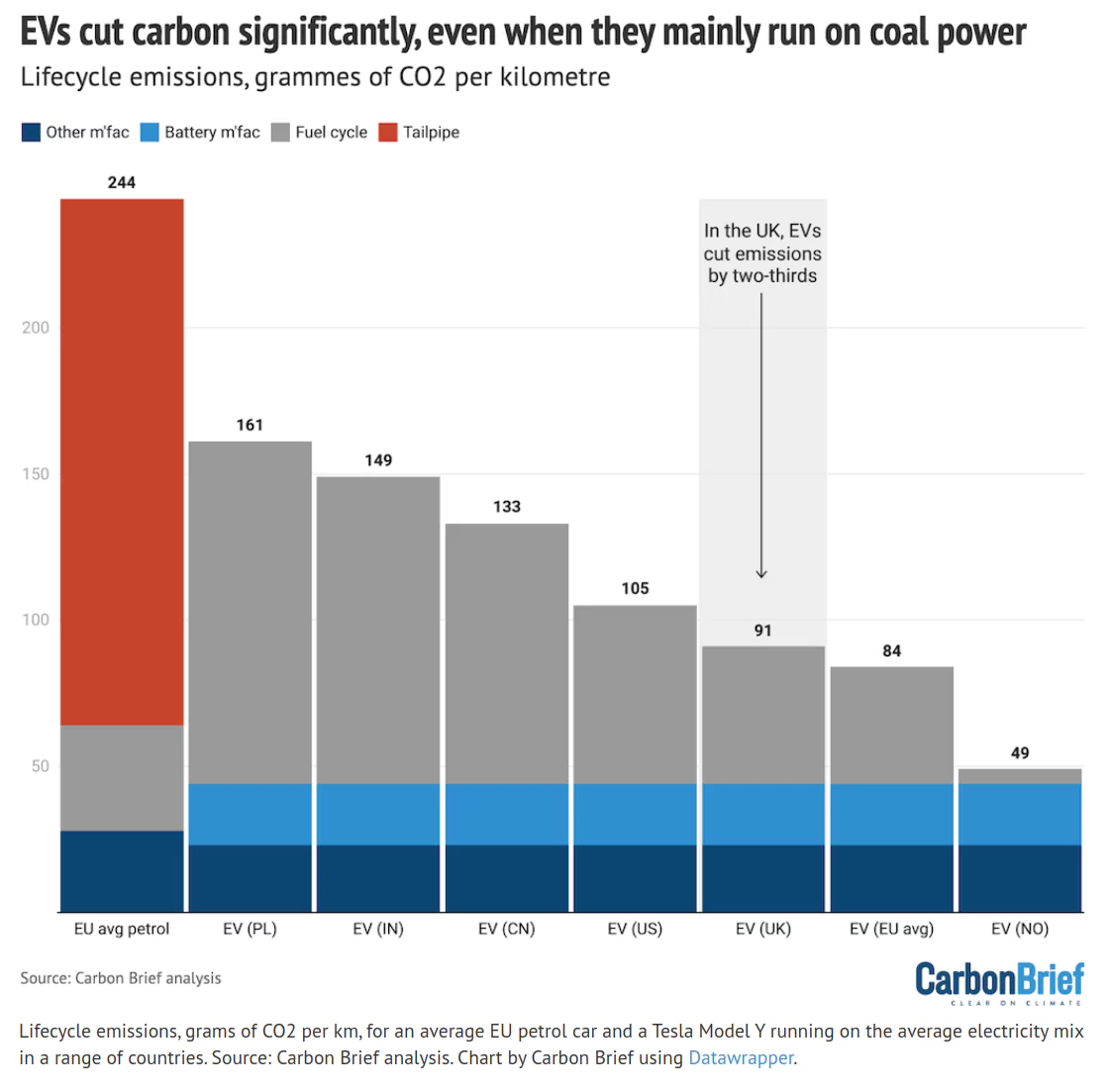

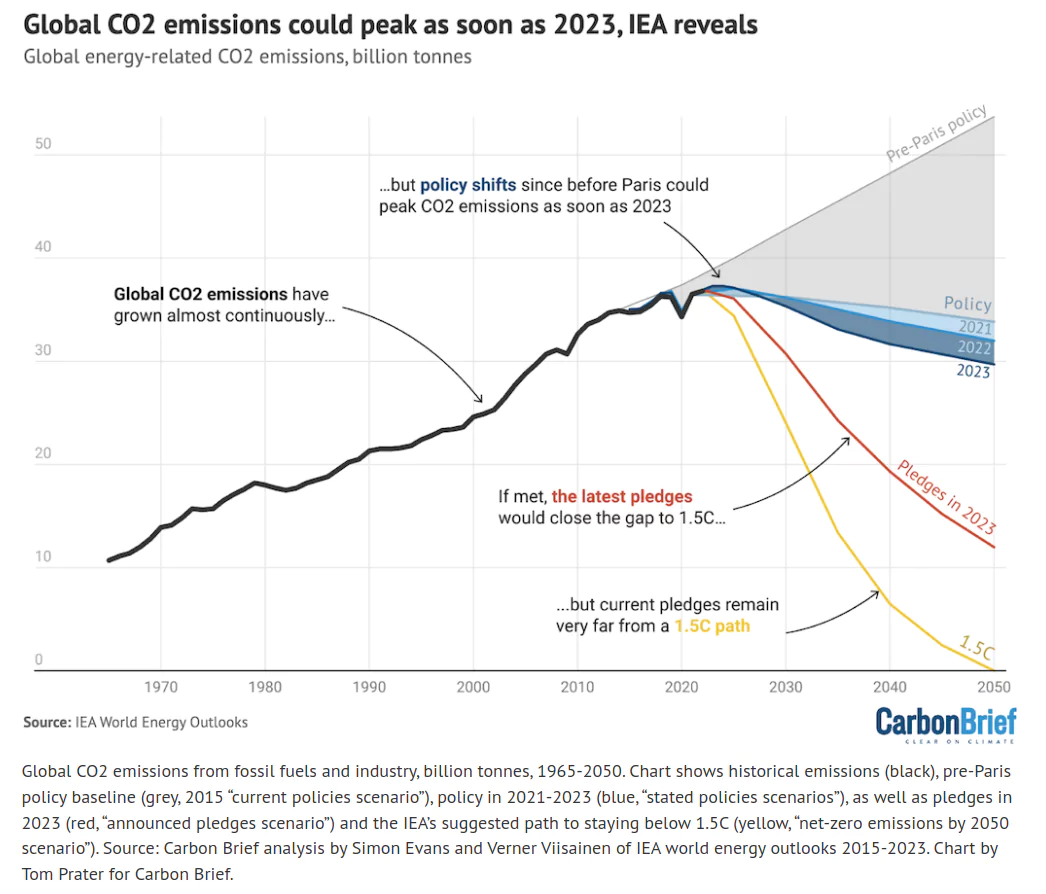

I came across a bunch of interesting insights related to climate change and decarbonization. Simon Evans, the deputy editor of Carbon Brief, published two amazing pieces on myths about electric vehicles and an analysis of the World Energy Outlook 2023 by the International Energy Agency (IEA).

Factcheck: 21 misleading myths about electric vehicles

A few highlights:

- It takes less than two years for a typical EV to pay off the “carbon debt” from its battery. Over the full vehicle lifecycle, carbon dioxide (CO2) emissions from an EV are around three times lower than an average petrol car. In reality, therefore, an EV in Europe will pay off its carbon debt after around 11,000 miles (18,000km).

- The IEA added that, by the end of the decade, EV sales were on track to displace 5m barrels of oil demand per day – some 5% of the current total – and to cut annual global emissions by 700MtCO2, roughly the current yearly output of Germany or Saudi Arabia.

- In general, EVs cut carbon emissions significantly, even if they mainly run on coal- or gas-fired electricity, as the chart below shows. In coal-heavy Poland, an EV would cut lifecycle emissions by two-fifths, Carbon Brief analysis shows, rising to two-thirds in the UK and four-fifths in Norway.

- While it is true that the production of EVs creates more CO2 than petrol equivalents – the US Argonne National Laboratory puts manufacturing-phase emissions at some 30-100% higher, depending on battery size – this carbon debt is paid off quickly. (See: FALSE: ‘An EV has to travel 50,000+ miles to break even.’) As a result, EVs still cut carbon significantly overall.

Analysis: Global CO2 emissions could peak as soon as 2023, IEA data reveals

Highlights:

- Global fossil fuel use peaking in 2025, two years earlier than expected last year.

- For the first time, coal, oil and gas each peaking before 2030 under current policies.

- Fossil fuel peaks being driven by the “unstoppable” growth of low-carbon technologies.

- The IEA boosting its outlook for global solar capacity in 2050 by 69% since last year.

- The IEA expecting 20% more electric vehicles on the road in 2030 than it did last year.

- A key focus on slowing economic growth and faster low-carbon uptake in China, where fossil fuel demand is now expected to peak in 2024.

Pair this article with this Twitter thread (fuck X) by Peter Zeniewski, energy analyst for the IEA World Energy Outlook.

Highlights:

- If you want to dismiss the idea of a peak in fossil fuels, you’d point to the strong historical relationship between GDP and fossil fuels. But this relationship is already changing and, in all our scenarios, it is transformed by the emergence of a clean energy economy.

- But clean energy has to work hard just to bring about a peak in fossil fuel demand. Look at solar: 1 GW existed in 2000. Now? 1 000 GW. In 2012, there were around 30 thousand EVs on the road. Now there are 30 million.

And this thread by Fatih Birol, executive director of IEA.

Robbie Andrew, senior scientist at the Center for International Climate Research (CICERO), published a thread on the top ten carbon emitters. India has overtaken the European Union (EU) to become the third-largest CO2 emitter. It looks like the change in order is in part due to the reduction in emissions in the EU.

Top ten emitters of fossil CO₂ per capita.

Rat-i-cal rethink

Rats are hideous and filthy vermin that spread pestilence and death, destroy our food, defile our homes, and steal our peace of mind. They are abhorrent, and they deserve to die in the most painful ways. Any creature that’s responsible for unleashing the plague that killed 30–50% of the total European population deserves to die a slow and gruesome death.

But are rats that bad?

The conventional wisdom is that rats are disgusting creatures that lay waste to everything in their paths. As it turns out, the conventional wisdom is wrong. J. B. MacKinnon published a whimsical and wonderful piece in Hakai Magazine on how rats are seriously misunderstood creatures. They didn’t cause the black plague, nor did they spread death and destruction wherever they went. If anything, rats are much like us. They are playful creatures that can learn, solve puzzles, and have distinctive personalities, and they love playing hide-and-seek. As for their filthiness, you can’t expect them to be clean when our cities are dirtier than ever with poor sanitation, a lack of waste management, and squalid living conditions.

Misconception is the order of the day with rats. Rats are aggressive, right? Bobby Corrigan, a legendary rodentologist and pest control expert in New York, has said that rats have never attacked him, “and I’ve put myself right in the thick of those animals, as thick as I can get.” But rats are filthy, right? In fact, they are such fastidious groomers, one scientist who researches laboratory animal welfare told me, that when she tried to use “permanent” ink to make identifying marks on rats’ tails, those marks were quickly cleaned away.

Even more surprising is how little we know about how often rats spread disease to humans. “We have no idea,” says Himsworth. She is, however, prepared to venture an educated guess. “Any rat you meet has the potential to have a disease,” she says. “But know that, in general, the risk—particularly for people in countries like Canada—is low.” Most people in wealthier nations live in sturdy, clean homes and have the resources to respond if faced with a serious rat infestation. On the other hand, a person who is living, say, in poor-quality housing, whose hygiene is affected by mental health struggles, and whose landlord refuses to act as rat problems worsen, is definitely at an increased risk.

In Defense of the Rat

Hat tip to Longreads for the rat-i-cal pun.

Laugh a little

I was watching this comedy special by the brilliant Patrice O’Neal, and I burst out laughing when I heard the bit about tricking God.

Patrice O’Neal: “Remember the good old days when you were a kid and you saw somebody with a funny-shaped head, and you pointed right at their head like it was nothing? You couldn’t stop yourself from pointing at that funny head that made you say, ‘Oh, Jesus, look at that funny-shaped head right there.’ It wasn’t that bullshit in you to stop. Now that we’re adults, we still want to point at a funny-shaped head, but we say to ourselves, ‘I can’t point at someone’s funny head.’ But your first feeling is your real feeling. That other shit is you trying to trick God into thinking you’re a wonderful person.”

A few wonderful thoughts

“I believe that reading and writing are the most nourishing forms of meditation anyone has so far found. By reading the writings of the most interesting minds in history, we meditate with our own minds and theirs as well. This to me is a miracle.”

Kurt Vonnegut

Hat tip to Matt Ruby

“See the collateral damage—the suffering—that results when you cling to your desires and opinions or take things personally. Over the long haul, most of what we argue about with others really doesn’t matter that much.”

Rick Hanson

Hat tip to Jim O’ Shaughnessy

Out of the money

In an interview with Abraham Okusanya and Robin Powell, Victor Haghani, founding partner at Long Term Capital Management (LTCM), said something interesting. It wasn’t the bit about index funds are great, but rather his comment about self-inspection. I work for a brokerage firm, and I see firsthand that most investors are oblivious to things like taxes, costs, and even basic performance measurement. The vast majority of retail money flows based on hope and ignorance and stays because of inertia. If most investors commit the damning sin of checking if what they are doing is working, markets will break.

Robin Powell: But the story doesn’t end there. The LTCM saga prompted Victor Haghani to look afresh at investing and, over the next few years, his investment philosophy changed completely.

Victor Haghani: So I got to this point and I was like, wow! I really need to focus on investing the remaining capital and savings of my family post-LTCM, and I kind of realised that, “wow, I’ve never really thought about personal investing at all.” you know, here I was almost 40 years old and I had never really thought about it. I was working in at the forefront of finance, but I never really thought about personal investing. When I was at Solomon Brothers, I was young, I was getting paid. They were putting half of my compensation into Solomon stock, and the rest of it, I would pay tax on and sort of just keep mostly in cash and not do much investing. Then at LTCM, it just seemed like the only thing to do with your money was mostly put it into the LTCM fund. That seemed like the thing to do.

So I wasn’t really thinking about investing. Yet all of a sudden here I was. So the first thing that I did is I looked around at people that I respected, people that I liked, and I looked at what they were doing. All of them were actively trying to beat the market through different kinds of alternative and private investments, and angel investing, and doing trading in their own accounts – almost to a man, to a woman. And so I decided that’s what I should do too. You know, I knew all these hedge fund managers. It was my world. I thought I could assess managers. I thought I could find good investments, and that it would be fun. And so that’s what I started to do.

So I did that for four or five years. And then one day – maybe around 2005-06, I just started to really take stock of what I was doing and what my life was like. I was spending so much time on it. I was paying so much in fees. And also as a taxable investor, I saw that what I was doing was highly tax inefficient as well: a lot of short-term capital gains, a lot of ordinary income, a lot of non-deductible business expenses for the US listeners. And so I sort of decided I really wanted to go back to basics and to start to move away from all these active, concentrated forms of risk and get to what I was taught when I went to the London School of Economics: invest in the market portfolio, get full diversification, be a long-term investor. And that started my different journey after working in an investment bank, in a hedge fund. Started, I guess, the third chapter of my relationship with finance.

This year marked the 25th anniversary of the collapse of LTCM. The collapse of LTCM is perhaps one of the most popular stories in finance—I’m surprised there isn’t a Netflix documentary on it. The interesting thing for me is that the episode has become a shorthand for smartness, not equating to results in investing. Here’s Warren Buffett himself:

If you take John Meriwether, Eric Rosenfeld, Larry Hilibrand, Gregory, Hawkins, Victory Haghani, the two Nobel Prize winners Myron Scholes and Robert C Merton, and the other twelve of them, they probably have as high an average IQ as any sixteen people working together in one business in the country, including at Microsoft or wherever you want to name. So, that incredible amount of intellect in that room.

Now, you combine that with the fact that those sixteen had had extensive experience in the field they were operating in. I mean, this is the one. It was not a bunch of guys who had made their money, you know, selling men’s clothing and then all of a sudden went into the securities business or anything. They had—they’d had in aggregate, the sixteen of them, probably 350 or 400 years of experience doing exactly what they were doing.

And then, you’re throwing in the third factor that most of them had virtually all of their very substantial networks in the business, so they had their own money up—hundreds and hundreds of millions of dollars of their own money up—super high intellect, working in a field they knew, and essentially, they went broke. And that, to me, is absolutely fascinating.

I mean, if I ever write a book, it’s going to be called “Why Smart People Do Dumb Things.” Yeah, my partner says it should be autobiographical, but I—I—but it: This might be an interesting illustration. And these are perfectly decent guys. I—you know—I respect them, and they helped me out when I was at problems with Solomon. And so, they’re—they’re not bad people at all. But to make the money they didn’t have and didn’t need, they risked what they did have and did need. And that’s foolish. That is just plain foolish.

I’d doesn’t matter what their IQ is if you—if you risk something that is important to you for something that is unimportant to you, it just does not make any sense. I don’t care whether the odds are a hundred to one that you succeed or a thousand to one that you succeed.

There are few other investing stories that have been co-opted by people to sell financial products as much as the LTCM story. It’s a story that launched a million investment product PPTs. This episode reminds me of another popular story involving survivor ship bias. No doubt you’ve seen this image floating around on Twitter threads. The story goes thus: during World War II, the Statistical Research Group (SRG) at Columbia University was trying to figure out better ways to protect bomber planes. So they looked at all the bullet holes in the planes that had returned, and they figured reinforcing the areas with holes would make them safer. However, Abraham Wald, a Hungarian statistician who was part of the group, noted that the group was looking only at the planes that had returned—the most damaged planes were the planes that had not returned. So he recommended adding armor to the least damaged parts of the planes. The inference was that if the planes had returned with bullet holes, that meant they could survive getting hit in those areas.

It seems to me that the whole trope that genius doesn’t equal success in investing based on the failure of LTCM is a little overdone. What about the actual geniuses who are successful?

A couple of other good reads on survivorship bias:

Most of us are regularly fooled by the survivor bias. Consider the plethora of business books readily available in airport bookstalls that feature the most successful companies. Smith analyzes two of the best sellers in the genre. In his 2001 book Good to Great (more than three million copies sold), Jim Collins culled 11 companies out of 1,435 whose stock beat the market average over a 40-year time span and then searched for shared characteristics among them that he believed accounted for their success. Instead, Smith says, Collins should have started with a list of companies at the beginning of the test period and then used “plausible criteria to select eleven companies predicted to do better than the rest. These criteria must be applied in an objective way, without peeking at how the companies did over the next forty years. It is not fair or meaningful to predict which companies will do well after looking at which companies did well! Those are not predictions, just history.” In fact, Smith notes, from 2001 through 2012 the stock of six of Collins’s 11 “great” companies did worse than the overall stock market, meaning that this system of post hoc analysis is fundamentally flawed.

How the survivor bias distorts reality By Michael Shermer | Scientific American

“How do you respond to the argument that Steve Jobs, Bill Gates, Michael Dell, and Mark Zuckerberg—all billionaires—dropped out of college?” I asked.

“And what about ‘John Henry’ and the 420,000 other people who tried ventures and failed?” Smith responded. “It’s a classic case of survivor bias. We make judgments about what we should do based on the people who survived, totally ignoring all the guidance from the people who failed.

High-Tech Dropouts Misinterpret Steve Jobs’ Advice by Carmine Gallo | Forbes

Aswath Damodaran

I really admire Professor Damodaran because he’s one of the most intellectually honest and self-aware people in finance. In an industry that revolves around big egos and personality cults, that’s a rarity. I started listening to a conversation featuring Professor Damodaran, and the start of the conversation stood out to me because I had read a tweet related to the topic:

Professor Damodaran: Let me pause you right there. I am not objective, but I’m open about my bias. So anybody who ever claims to be objective is right off the top line. None of us as human beings is ever capable of being objective. All we can do is be open about our biases. I am open about my biases.

Larissa Fernand: Okay then, let’s start with your biases. Can you tell me a bias that you have successfully overcome and one that you are combating with right now?

Professor Damodaran: I don’t think you ever fully overcome a bias because it’s built into you. It’s in your DNA. All you can do is be aware of it. So I’ll give you an example. I love Apple as a company. I’ve loved it since 1981 when I bought my first Apple. And I struggle with that love of the company every time I evaluate the company. I can’t make it go away. It is there. But one of the things I can do is when I make a choice, I can always step back and say, “Did I make the choice because I like Apple as a company?” But I make a choice based on something that’s more soft, something based on the numbers. So I think it’s an ongoing process. You never get rid of it because it constantly recreates itself.

The tweet was from Steve Stewart-Williams about a new paper on bias blind spots. I couldn’t find an open version of the paper, but I found a different study on the same topic:

“When physicians receive gifts from pharmaceutical companies, they may claim that the gifts do not affect their decisions about what medicine to prescribe because they have no memory of the gifts biasing their prescriptions. However, if you ask them whether a gift might unconsciously bias the decisions of other physicians, most will agree that other physicians are unconsciously biased by the gifts, while continuing to believe that their own decisions are not. This disparity is the bias blind spot, and occurs for everyone, for many different types of judgments and decisions,” said Erin McCormick, an author and Ph.D. student in behavioral decision research in CMU’s Dietrich College of Humanities and Social Sciences.

We’re perfect; it’s the other people that suck!

The road to ruin is paved with good stories. This piece on market delusions was really good. Investors will be far more successful if they just diversify broadly with low-cost index funds and do something useful in their lives, like watching Fabulous Lives of Bollywood Wives on Netflix.

The key point is that when an investor bets on a new technology or industry becoming huge based on the size of its potential market, even ‘diversifying’ by investing in multiple companies within that industry won’t necessarily protect them from losses, because when the entire industry becomes overvalued, the resulting correction is likely to affect everyone. The simple way to avoid getting caught up in big market delusions is by remaining broadly diversified across markets – and for advisors, the lessons learned from previous examples of big market delusions can help guide clients on avoiding the next one!

Aging Population Affects Economic Growth but Not Stock Returns by Larry Swedroe

While their findings document that a demographic drag could be the new normal in the upcoming decades for most OECD countries, economic growth depends not only on how cohorts change but also on how labor productivity changes with improvements in functional capacity as longevity rises. Improvements in functional capacity can cushion much of this slowdown. Thus, perhaps the consequences of population aging will be less severe than demographic predictions suggest, as immigration and technological progress can reduce the demographic drag by cushioning labor shortages, automating physically demanding tasks, and creating age-friendly jobs.

That’s it for this week. Go make someone laugh but try not to punch little kids.