The good place edition

Post status: Permanent Draft

This is an incomplete post because I’m still learning about the ideas I’ve written, but you’ll love them—I promise you. If not, I’ll give your money back.

Wait, you don’t pay me, you cheapskate.

Also, this is not a post with a start and an end. It’s more of a log of things I’ve learned about moral philosophy. I intend to keep adding to the post as I learn more. With that, you’re welcome for the wisdom I’ve oozed in this post. Some of the ooze will stick with you, for sure. So let’s get sticky.

You wake up early in the morning and then head to the potty to sit on that sweet Japanese toilet with a heated seat, an auto-butt washer, and Alexa support that makes your butt cheeks feel like warm toasty buns. You spend the first 2 minutes adjusting your tushy placement and making sure the vastu is right.

Then you unload the contents of your stomach with such great fury that your neighbors confuse the sounds for thunder and lightning. They also get to know that you had a hemp-based Korean barbecue burger the previous day.

Then you head to the gym. As you start driving to the gym to chisel those abs of yours that look like speed bumps on Bangalore roads, you have a choice: take the regular but slightly longer route or a quicker route by driving on the wrong side of a one way road. Remember, them abs gots to be chiseled and butt cheeks toned! So, time is of the essence, what do you do?

One day, you are stuck in slow-moving traffic and bump into the car in front of you. Luckily, there’s only a small mark and no major damage. You exchange phone numbers and insurance details with the driver, then head home. After a few days, you get a bill for $836 because the car owner wants to replace the entire fender, even though the mark you caused is barely noticeable.

You’re livid. You tell the driver that he’s being ridiculous, but he’s adamant that he wants to replace the fender. You tell him that you won’t pay him but instead donate the $836 to the Red Cross and ask him to think about it. Then you go back to work and tell your co-workers about the incident. They’re also mad and offer to donate money to the Red Cross along with you.

You get the bright idea to start a blog and tell the world about this ridiculous incident. Your blog goes viral, and soon other people offer to donate money. Before you know it, the press picks up the story, and you’ve managed to collect over $20,000. After a while, you feel sick to your stomach. You know there’s something wrong, but you can’t quite put your finger on it.

What do you do?

Are you a dick?

How do you figure out if you are a dick and fix things?

The second story is a real one. I can neither confirm nor deny if the first one is. The second story involved Michael Schur’s wife. Michael is a legendary writer responsible for awesome TV shows like The Office, Parks and Recreation, Brooklyn Nine-Nine, and The Good Place.

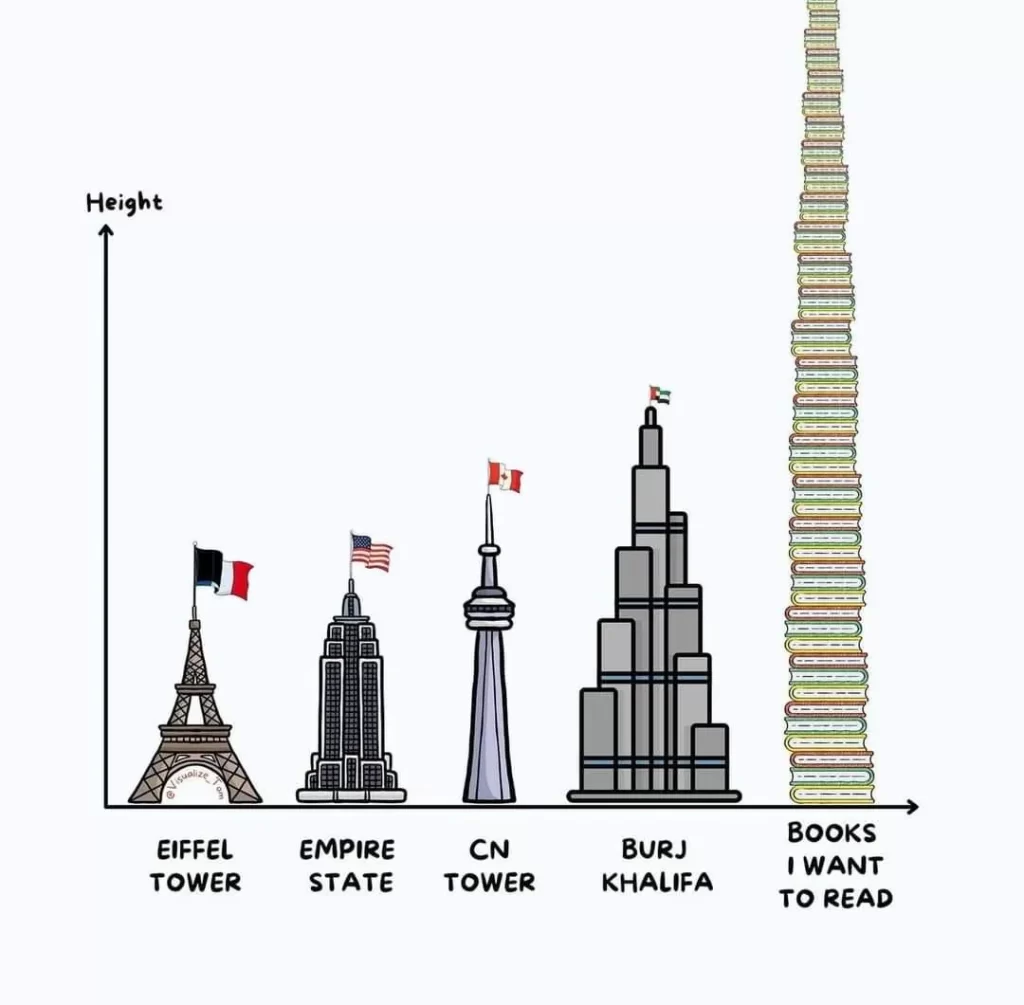

You may have noticed that I’ve been trying to learn a little about philosophy. I’ve bought a bunch of introductory philosophy books and am listening to random philosophy videos and podcasts.

Somehow, in doing this, I discovered Michael Schur, and I’ve been bingeing on his podcasts for the past couple of weeks. Michael is a friggin genius, and I am ashamed that I hadn’t heard of him despite having watched Brooklyn Nine-Nine and The Good Place.

Michael describes himself as an “intense rule-follower” who was always interested in ethical questions but didn’t know much about ethics. He’s so ethical that he plays this weird little game in his head:

Michael Schur: I feel like I play a game in my life where I see good or bad behavior, and I essentially play God. I go, like… I’ve told the story many times, I apologize if you’ve heard it, but one of the starting points was like, I was in traffic in LA because you’re always in traffic in LA, and a guy in a Lamborghini pulled into the breakdown lane and just…

Jon Stewart: May I… If you’re here tonight, fuck you. Yeah, go ahead.

Michael Schur: That’s right. He’s not. He definitely died in a fiery car wreck, by the way. So he just zipped past everybody, and I did a thing I do a lot, which I was like, “You just lost 20 points.” Like, I would play that game with myself of like, “That’s negative 20, man. What you just did… I don’t know if anyone’s keeping track, but if they are, you lost 20 points.” It’s a video game. I played… I observed behavior and assigned points like it was a video game.

And then, after like the 700th time that a Lamborghini did that, I was like, “Well, maybe there’s a show there. Maybe, like, what if that is the way it’s being… What if we are playing a video game, essentially, and someone actually is keeping track?” And the top… The people on the top of the scoreboard leaders get up [makes an upward gesture to mean heaven], and then everyone else [makes a downward gesture to mean hell].

All these things led him to create The Good Place and also write How to Be Perfect: The Correct Answer to Every Moral Question—a book that tried to make moral philosophy accessible. After listening to several of his podcasts, I ordered the book. I’m only about 30 pages in, but the book is delightful and funny. It’s one of those rare philosophy books that doesn’t feel like splashing Domex in your eyes for even attempting to read it.

I also started to re-watch The Good Place—I had forgotten how good the show is. The show revolves around four people who end up in “The Good Place,” a heaven-like place, despite being terrible on Earth in their own ways. Soon, they discover that they are actually in the Bad Place. So they enlist the help of Chidi Anagonye, an ethics professor, to help them become better and earn their place in The Good Place.

The show explores various philosophical ideas and questions, like what it means to be good, the meaning of the afterlife, the trolley problem, and so on. It’s also filled with references to Aristotle, Immanuel Kant, John Locke, David Hume, and Thomas Scanlon. It’s not often that a show can make philosophers, who induce feelings and behaviors ranging from mild seizures, depression, and gratuitous anger to suicide, digestible.

Speaking to comedian Pete Holmes on his podcast, Schur explains the motivation for writing the book:

Michael Schur: I don’t want this book to be like an indictment of the way that we are, because I feel like life is really hard for most people. You and I, I would say, are among the luckiest… We’re two of the luckiest people on Earth. Like, if you made tiers, we’re in tier one with room to spare. Like, we’re in tier one right in terms of just good fortune.

So I don’t want it to be an indictment. What I do want to say is that there are things that some of the world’s smartest people have been thinking about for thousands and thousands of years, and what they’ve been thinking about is: How can we be good people? What is valuable in life? What it’s like… How can we act and behave in ways that are productive and positive as opposed to destructive and negative?

And the problem has been largely that those people wrote only for each other at some level, and as a result, their books and writings are dense, impenetrable, and boring. And that’s… It’s like, the image I kept having in my head as I got into this stuff was like, imagine someone wrote a recipe for, like, chocolate cake that also made you smarter and you got into better shape when you ate it. Like, you’ve got ripped abs. It’s a delicious chocolate cake that gives you ripped abs. But now imagine that the recipe was seven hundred pages long and written in German. And so, no one wanted to read it. And it’s like, if more people could read this stuff, it would benefit the world.

I couldn’t agree more. I just finished reading From Socrates to Sartre. It’s a book that’s supposed to introduce you to the ideas of some of the greatest western philosophers, like Plato, René Descartes, David Hume, Georg Wilhelm Friedrich Hegel, Karl Marx, and Jean-Paul Sartre. Yet, it takes some effort to understand the summaries, or maybe I’m bloody dumb.

A lot of the words and terms that old philosophers use are maddening. Even if you read things in English, it feels like Latin or black speech. In the case of Hegel, I’ve read the chapter on him three times, and I’m still not sure if I’ve understood his ideas. Reading philosophy can sometimes feel like going to the nearest hardware store, buying a 10-inch-long Tata Steel TMT bar, and smashing your head until the pain stops.

I may be generalizing, but I don’t think most people can understand the original texts of Kant, Hegel, and Hume. If books that summarize their work are hard to understand, then the original books are bound to give people an involuntary lobotomy.

I’ve only spent a few months diving down the philosophy rabbit hole, but it’s clear to me that learning philosophy can make one’s life and thinking richer. Even if you don’t buy that, you at least get to use philosophical terms and concepts in a hand-wavy way and look cool.

Why should we not be assholes?

Why be good?

That’s the question I had after listening to Mike Schur and reading and listening to a bunch of other philosophers over the last couple of weeks.

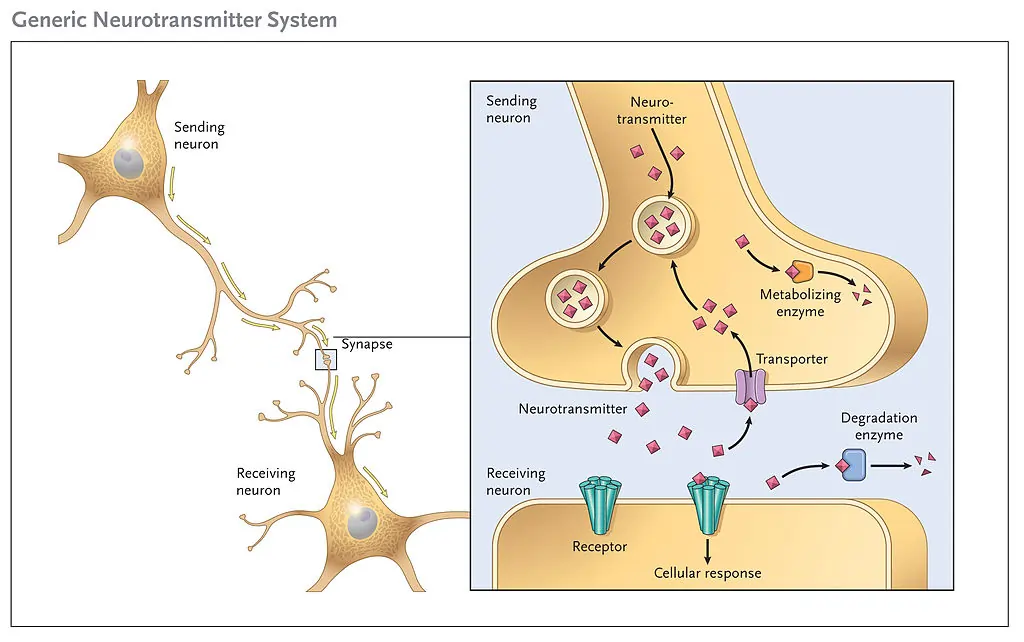

In previous posts, I had written a little bit about determinism vs. free will. Determinists believe that everything is predetermined and governed by the laws of nature. All our actions and choices are the result of the preceding events. Here’s how physicist Brian Greene explains the idea:

Brian Greene: If your notion of that agency, if your notion of that free will is the version, and I think we all intuitively have that, we are the ultimate authors of our actions; we are the originators of those decisions, choices, and intentions to which you referred. That is incompatible with our understanding of physical law because you and I are both just big collections of particles, and those particles are fully governed by the ironclad laws of physics.

So, every action you take, every decision you make, and every thought that you have is nothing but your particles moving from this configuration to that configuration, and that move is fully governed by mathematics. So, the feeling of making a choice, the feeling of freedom, the feeling of intentionality—that’s real. The causal influence of what you do is certainly real; you are part of the causal chain of how things evolve from here to there if you are involved in that process. But you are not the ultimate author of that process; that process has been set in motion a long time ago, and your particles are merely carrying out their quantum mechanical marching orders, and you are a vehicle that allows that to happen.

Believers in free will argue that not everything is predetermined and that we are the ultimate authors of our destiny.

If you believe there’s no free will, then everything is predetermined. So what’s the point of being good?

For centuries, the answer has been God.

Many people believe that there’s this omnipresent being in the sky watching all our actions. It looks like the gods need MNREGA, no? God has universal accountants that keep track of all the good and bad shit we do. After we die, the points are tallied up, and if we did more good than bad, we get to chill in the good place with unlimited food that doesn’t make you fat, alcohol that doesn’t give you hangovers, free virgins, and best of all you can wash you ass with water—unlike Bangalore right now.

If we did more bad than good, then we’re barbecued for eternity while being forced to watch Fabulous Lives of Bollywood Wives in Tamil on rewind.

What if you don’t believe in God and all that happens after you die is that you turn to dust and your relatives fight to sell your body parts to invest in stocks?

Why be good?

Blaise Pascal has a proposition for you. If you had to bet on whether God existed or not, the reward from betting that he exists would be far better than betting that he doesn’t:

Pascal’s wager is the name for an idea by Blaise Pascal. He said that it is not possible to prove or disprove that God exists and that when it comes to God’s existence, we are taking a big risk. Pascal thought it is better to bet that God exists, and therefore to live accordingly. If God exists, we could gain a lot, like eternal happiness in Heaven, but if God did not exist it would make no difference. For this reason, it would be better to believe in God, Pascal said. — Wikipedia

You might say that’s not convincing. You might point to all the assholes in the world that are doing shitty things and making tons of money. You might ask, Why should you not do the same if there’s no such place as hell?

Ryan Holiday asks Schur a similar question: “How do you not just go, “Fuck it, I’m a nihilist, right? Or, like, how do you not give up on people?” I love his answer:

Michael Schur: As long as you keep that in mind, I hope you can’t get to a point where, even as tempting as it is to just do whatever everybody else is doing that sucks and is giving them some potentially a head start in the race, or is helping them in some way financially, socially, or whatever, it just can’t be the answer to say, “I know that thing is bad that that person is doing, but I’m going to also do it in order to attain whatever that person is attaining.”

And part of that, by the way, I think is also keeping in mind—and this is obviously a Stoic idea as well as an Eastern idea. There’s a lot of philosophy that talks about how if you are attached to things, if you have the wrong kinds of attachments, or if you care too much about attaining certain things, you’re on the wrong path. It’s very Buddhist, right?

If you’re saying, “If I’m looking at someone in a position of power who is using his or her political influence to steer money towards a company that he or she owns stock in to gain financial wealth, and I say, ‘Well, I guess I’m gonna do the same thing because if they don’t care, why should I care?'”

The root of that is the idea that the thing that they’re gaining matters, right? That it’s like, “Oh, that extra twenty-three thousand dollars in stock appreciation is something that I should care about.” So if you don’t think it’s worth what you’re giving up to get it – yes, the price of your soul is that extra money.

So if you start from a position where you’re going to make sure that you are attached to the right things, to caring about that you’re mindful, that you’re focused on what actually does matter – you will start to see that the things that they’re selling parts of their souls for aren’t worth it, because the thing they’re trying to attain is not something you should even care about attaining.

And that’s hard. It’s hard to say to people, “Money doesn’t matter,” or “A bigger house or a nicer car doesn’t matter.” It’s hard to believe in that sometimes. But that’s the deal – you gotta start from that position, I think, and then go from there.

Or, you can be good, because being good is better than being bad. If you’re bad, things might be good for a while but then life will be miserable. But if you’re good in life, it leads to knock-on effects. Everything around you becomes better, and life becomes enjoyable. There are more good people than bad for a reason. Richard Dawkins says that morality emerged as a result of the evolutionary pressures of natural selection.

Can you be good?

The first chapter of Mike Schur’s book is about Aristotle’s virtue ethics. Aristotle says that the purpose of life is eudaimonia, or flourishing. To flourish, we need to live a virtuous life.

How do you live a virtuous life?

Well, you need to have certain virtues like courage, justice, and temperance.

Can you order virtues on Amazon?

You wish.

You become virtuous by doing virtuous things.

Yeah. Disgusting! But them’s the rules for free, unlimited, non-hangover-inducing beer and whiskey in the afterlife.

But philosopher Pamela Hieronymi, who consulted for The Good Place, doesn’t think so (archive) or rather has a nuanced answer.

Pamela Hieronymi: I think what got Mike’s attention on my website was this paper about what, at one point, was called “Why You Can’t Be Good by Trying.” The thought is, if you need to be a better person, it’s because you lack good motives—something about your motivation. And Aristotle says—and it’s good advice—I don’t mean to say it’s bad advice—but Aristotle says, If you need to be a better person, do what the good person does. So basically, fake it ’til you make it, right? Imitate the good person until you become a good person.

But what’s weird about this—what’s puzzling about this—is that motives aren’t like muscles. It’s not like repetition makes them stronger, or something. So in order to—if practice makes perfect—why wouldn’t faking it just make you a great faker, right? Why wouldn’t you just become really good at imitating the virtuous person?

It seems like something has to happen that changes you; something has to happen so that your motives shift. And that shift, I think, isn’t just effort, despite the fact that Mike loves to say “trying”—and I I don’t mean to be disparaging the goodness of trying—but mere effort is not going to get you there without openness, right? Without a kind of openness to learning.

So it is what I would say, going back to when Todd was talking about his daughter just listening, just being open to other people’s experiences, being open to seeing things a new way, being open to thinking maybe I’m not so great, or maybe this wasn’t something I merited by my own bootstraps, or maybe I’m not giving myself enough credit, maybe I actually should be taking more credit for some… You know, all of these things seem to me a kind of – yeah, so my brief would be for a kind of openness and learning.

I agree with Pamela. You can’t fake being good. Doing the right thing comes from a genuine desire to do the right thing. That means, your intent has to be right. Your intent can only be right if you have a genuine desire to learn and change your shitty attitude. That change can happen if you do as Eminem says:

In my shoes, just to see

What it’s like, to be me

I’ll be you, let’s trade shoes

Just to see what it’d be like to

Feel your pain, you feel mine

Go inside each other’s minds

Just to see what we find

Look at shit through each other’s eyes

How not to be an asshole?

The first step to not being an asshole is to know that being an asshole is bad. As tragic as it sounds, some people spend their entire lives blissfully ignorant about their asshole…ness. In other words, you need to live an examined life, as Socrates said, but in the right amounts.

“Socrates said that an unexamined life is not worth living. But you know, an over-examined life can be a real crap festival, too.” ― Alex Bosworth, Chip Chip Chaw!

An examined life can lead to wonderful things. You could argue that thinking about how to live a good life is what put Mike Schur on a path to creating The Good Place and writing How to Be Perfect.

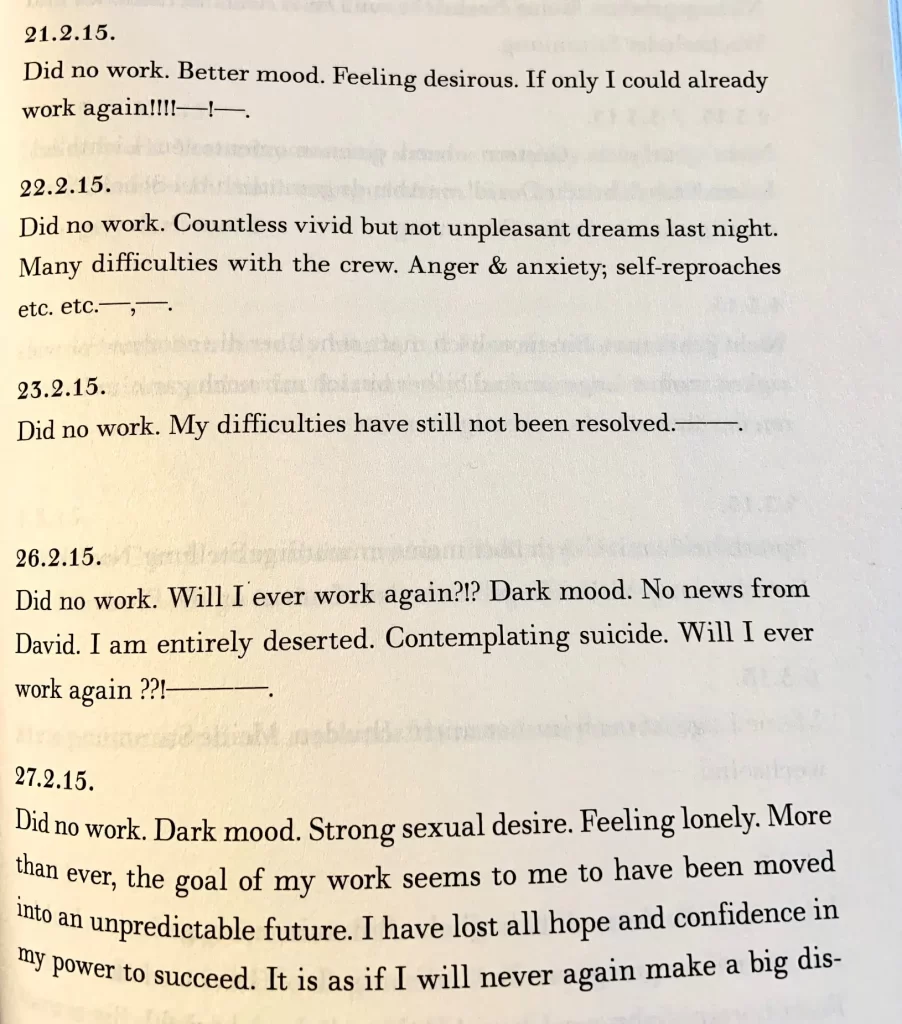

On episode 13 of the show, there’s a beautiful illustration of an examined moment. Despite helping raise billions for charities, Tahani ends up in the bad place because her motivations are corrupt and she hadn’t thought about it:

Eleanor Shellstrop (Kirsten Bell): Wait, I don’t get something. I know why Jason and I were sent here, but why Tahani?

Jason Mendoza: Oh yeah, didn’t you raise like $1000 for charity or whatever?

Tahani Al-Jamil: $60 billion, actually. Oh, but it didn’t matter. Because my motivations were corrupt. I didn’t care about helping the people I raised the money for. Parents wrong. Because my motivations were corrupt. I didn’t care about helping the people I raised the money for. I just wanted to prove my parents wrong, stick it to my sister, and get fame and attention. My only real goal was to snog Ryan Gosling at the Met Ball. Which I did. A couple of times, actually.

This is why it’s important to have a philosophy of life. In the book, Schur focuses on the three major schools of moral philosophy:

Virtue ethics

Virtue ethicists say what’s most important is a person’s moral character. They say that we should cultivate virtues like wisdom, justice, courage, and temperance and live life in accordance with them.

Utilitarianism

Utilitarianism is a consequentialist philosophy that says that the morality of an action should be judged by the outcome. Utilitarians say that the right choice is the one that produces the greatest amount of good or happiness for the greatest number of people.

Deontology

In contrast to consequentialism, deontology judges the morality of actions based on whether they follow certain universal moral rules. The outcome doesn’t matter. Immanuel Kant is a key figure in deontology. His thing is that you need to make choices based on rules that can be universal. In other words, act in a way that you’d expect others to act in the same situation.

Each philosophy has its own pros and cons, and it’s impossible to only follow one. For example, if you were to live life as Kant says by acting as you’d expect others to live, then you wouldn’t be able to lie regardless of the consequences. Imagine being truthful when your partner asks you if they are looking fat in a new outfit. It’s going to end really, really well!

You need to build your philosophy by picking the good things that suit your temperament and discarding things that don’t. Speaking about philosopher William James on The Tim Ferriss Show, Mike Schur says something similar:

Michael Schur: He doesn’t care what method you use as long as you get to some kind of truth or fact, and then base your decision on that truth or fact.

There’s something just very lovely… I describe it in the book as the jambalaya of philosophy, right? It’s like throw everything into the pot, everything we’ve got. Use whatever we can. He doesn’t care what theory you use or how you arrive at the truth as long as what you’re arriving at is the truth.

So I really like that approach because in a modern world… I mean, for him, the modern world was like 1896 or whatever. For us, the modern world is 2023. Things have already… or 2022. Things have already gotten so much more complicated than they were a hundred years ago, but he was looking around at an increasingly complex world and saying, “We don’t have time to only use one theory here. We got to use all of them. We got to use everything we have. Every tool in our tool belt, we should be able to use at any moment in order to arrive at something that we can agree upon is true.”

The wonderful thing about the book is that humanizes philosophy and makes it bearable. I want to share two wonderful excerpts from the introduction of the book that tie into the question of how not be an asshole:

To make it a little less overwhelming, this book hopes to boil down the whole confusing morass into four simple questions that we can ask ourselves whenever we encounter any ethical dilemma, great or small:

What are we doing?

Why are we doing it?

Is there something we could do that’s better?

Why is it better?

That’s moral philosophy and ethics* in a nutshell

There’s no perfect answer:

Part of me doesn’t entirely blame them [people who don’t care about being ethical], because attempting to be a decent moral agent in the universe—a fancy way of saying “trying to do the right thing”—means we are bound to fail. Even making our best efforts to be good people, we’re gonna screw up. Constantly.

We’ll make a decision we think is right and good, only to find out it was wrong and bad. We’ll do something we don’t think will affect anyone, only to find out it sure as hell did, and man are we in trouble.

We will hurt our friends’ feelings, harm the environment, support evil companies, accidentally help an elderly Nazi cross the street. We will fail, and then fail again, and again, and again. On this test, which we take daily whether we want to or not, failure is guaranteed—in fact, even getting like a C-plus often seems hopelessly out of reach.

All of which can make caring about what we do—or in the modern parlance, “giving a crap”—seem pointless. But that failure means more, and has more potential value, if we do care. Because if we care about doing the right thing, we will also want to figure out why we failed, which will give us a better chance to succeed in the future.

Failure hurts, and it’s embarrassing, but it’s also how we learn stuff—it’s called “trial and error,” not “one perfect trial and we nail it and then we’re done.” Plus, come on—the alternative to caring about our ethical lives is really no alternative at all.

A simple philosophy of life

Speaking at an event hosted by Stanford’s Ethics and Society program, Schur ended his opening remarks by citing the Delphic maxims:

Michael Schur: When the ancient Greeks wanted to distill their worldview into its simplest form, they chiseled three pithy statements into stone: “Know thyself,” “Nothing in excess,” “Surety brings ruin.”

In modern parlance: Understand who you are and what you believe. Be moderate in your thoughts and actions. Don’t be so sure you’re right that you forget to contemplate the possibility that you are wrong.

When it comes to teaching people how to act, and think, and feel, I’m not sure we’ve come up with a better philosophy in the ensuing 2,500 years. I’m not sure anyone will ever come up with a better philosophy of life, or goodness, or the search for virtue.

But I wholeheartedly encourage all of you, with your big, juicy brains, spending your formative years at one of the world’s greatest universities, to try.

I agree; these maxims are probably the most minimal philosophy of life you can live by. You could certainly do worse.

The other idea that I loved was incremental progress. On the podcast with Pete Holmes, Michael used the Moneyball analogy to talk about progress:

Michael Schur: So it’s very tempting to say, “Oh what’s the point of any of this?” Like, the stuff that needs to change has to change on such a massive institutional level that me making my own little stupid decisions… Even when, like I said, you and I are lucky people. We have good sized houses and we have, like, I have a yard, and I have two cars—my wife and I both have a car. And that immediately puts us in the one thousand of one percent of good fortune people in the universe.

So even then, how big is our impact really going to be? And then you realize, well, this isn’t just about me. It’s about all of us. If we all did whatever it is we’re suggesting we do, if everybody tried a little harder, if we Moneyball this shit, basically…

Do your remember the story of Moneyball?

Pete Holmes: I’m obsessed with Moneyball.

Michael Schur: If you haven’t seen it, Moneyball is like this team with no money. They lose their star player, they have no money. And they say, “Okay, instead of finding one guy who is this good, we’re gonna replace eight guys on our team with eight guys who are like four percent better than they used to. And then combined, they will have the power of replacing this one guy.” Everybody thought the manager was nuts, but the team ended up completely dominating.

And yes, now everybody does it. It’s lost its advantage. He foolishly allowed Michael Lewis to interview him, really, and then suddenly everyone copied what he did. But at first, people wouldn’t notice.

Pete Holmes: It’s like when you put out a new food or something – we can analyze it now. If you’re selling an amazing pancake, science can buy that,

Michael Schur: Put it in a centrifuge and separate the egg from the wheat or whatever. So the point of all this is that we as a society can just Moneyball this stuff. If we can all be four percent better than we were yesterday about anything – about water conservation, or using electricity instead of gas, or whatever – if we’re all four percent better, a lot of amazing stuff will happen.

And so all you can really control is your own behavior, and maybe you can influence the behavior of the people around you. Everyone should try to do that. Everybody should try to make themselves four percent better than they were yesterday, and help other people with new ideas to make themselves four percent better. And eventually we’ll crawl, kicking and screaming, into a brighter future.

I’d recommend watching The Good Place. It’s brilliant. I’ll keep adding to the post below as I learn more about moral philosophy.

You’re welcome for all the wisdom I share for free. Don’t you feel bad for not paying me money to share all this? Ooh, I’m sure you are going to The Good Place for doing this.

Leave a Reply